Vantage Markets broker review

Vantage Markets broker review and test – Is it a scam or not?

Today, the selection of online brokers is extensive, and it isn’t easy to find a trusted trading partner. Vantage Markets is a well-known company from Australia, which also serves international customers, but is Vantage Markets a good forex broker or not? – In this review, you can read about my personal experiences with the leveraged derivatives online broker. Find out about the conditions for traders and find out if investing your money there is worthwhile.

➔ Sign up for free with Vantage Markets now

(Risk warning: Your capital can be at risk)

What is Vantage Markets? – The company presented

Vantage Markets is an international broker for Forex (currency pairs) and CFDs (Contracts for Difference). The company has existed since 2009 and knows exactly how to respond to the wishes of its customers. The broker is mainly based in Level 29, 31 Market Street, Sydney NSW 2000, Australia, and accepts traders from almost every country. But they also got business addresses in the Cayman Islands and Vanuatu.

Vantage stands for transparent trading on the financial markets. This can only be said of some brokers and is very difficult to recognize, especially for the beginner. The strengths of Vantage Markets are transparent order execution and liquidity delivery. It is one of the few true ECN brokers. This means that the broker is connected to a network of large liquidity providers. These accept the order of the traders. The liquidity providers are transparently visible on the homepage. Large, well-known banks (HSBC, Bank of America, UBS, and more) are among them.

Facts about Vantage Markets:

- Australian broker founded in 2009

- International Broker which accepts any clients

- Transparent trading with leveraged derivates

- Works with big liquidity providers

- Real ECN orders and CFDs (Contract for Difference)

https://www.youtube.com/embed/blntJYcjHWY?feature=oembedReview of Vantage Markets, formerly known as ‘Vantage FX’

➔ Sign up for free with Vantage Markets now

(Risk warning: Your capital can be at risk)

Regulation and safety of the customer funds

For secure online trading, broker regulation is required by most traders. The company must have an official license (through licensing/regulation) from a government agency to offer financial products. Official laws are always subject to specific criteria and rules that a broker must adhere to. In case of violation of these rules, an immediate withdrawal of the regulation and license threatens. The regulation thus creates a high degree of trust between the trader and the broker. Fraud can be completely ruled out with an utterly regulated offerer to 99%.

Overall, Vantage Markets offers a very high level of security. The broker is regulated by the Australian regulator ASIC, the Cayman Islands Monetary Authority CIMA, and is audited by KPMG (auditing firm).

Every quarter, the security and administration of client funds are reviewed, and corresponding financial reports are published. For Vantage Markets, the safety of client funds is essential. Therefore, there is also additional protection by liability insurance of 20 million USD.

Client funds are kept with the National Australia Bank. This bank has the highest rating and a market capitalization of more than $ 93 billion. This is one of the safest banks in the world, and client funds are kept separate from company funds. Vantage Markets is one of the safest brokers in the world compared to other brokers due to the facts mentioned above. No other company offers such security as Vantage Markets through so many parts of the business.

Reasons why Vantage Markets is one of the safest brokers:

- Clients’ funds are held at one of the top 20 banks in the world

- Vantage Markets is audited by the auditors of KPMG

- Regulation and licensing by the Australian regulator ASIC

- Regulation and licensing by the Cayman Islands Monetary Authority

- Liability insurance of over 20 million USD

➔ Sign up for free with Vantage Markets now

(Risk warning: Your capital can be at risk)

What are the conditions for Traders of Vantage Markets?

Overall, Vantage Markets has more than 180 different tradable assets. These include forex (currencies), indices (Dax, SP500, etc.), commodities, precious metals, energies, and cryptocurrencies. The selection here is very large and every trader should find his matching asset to trade. The broker is constantly striving to expand the offer and to implement new markets.

Vantage Markets also offers 3 different account models (STP, RAW ECN, and PRO ECN – more on that below). The leverage can be up to 1:500 high for all accounts, and the spreads start depending on the account model from 1.4 pips or 0.0 pips. The commission per traded 1 lot is either $ 3 or $ 2 high. This is from my experience a very small and cheap value. Therefore, Vantage Markets is among the cheapest forex brokers.

There are 8 different base currencies available for the trading account, and an Islamic account version is adjustable. Incidentally, there are no hidden account maintenance fees. After my tests, the execution for trades at Vantage Markets is sensational and happens directly without requotes. You can rent a VPS server if you need an even faster connection. The support team will be happy to help. In summary, Vantage Markets stands for a professional trading experience at low fees. The offer and the terms of the broker clearly exclude the competitors.

| FOREX PAIRS: | 44+ |

|---|---|

| STOCK INDICES: | 15+ |

| COMMODITIES: | 10+ |

| STOCKS: | 500+ (UK, US, Europe, Australia) |

| CRYPTOCURRENCIES: | 40+ |

Facts about the trading conditions:

- Minimum deposit $ 200

- Over 300 different markets

- Several account models (commission-based and spread-based)

- Leverage up to 1:500

- No account maintenance fees

- Very cheap trading fees

- Spreads starting at 0.0 Pips

High leverage for European traders – Avoid ESMA regulation

The new ESMA regulations mean that brokers in the EU can no longer lend high leverage to private traders. The maximum leverage for private traders in Europe is 1:30. As a result, many trading strategies are no longer feasible, and trading is restricted by many traders. A way out of the new bureaucracy will provide brokers with a license and regulation outside Europe. Vantage Markets is unaffected by ESMA regulation and offers all traders high leverage of 1: 500. Also, traders can trade under the ASIC or CIMA regulation.

➔ Sign up for free with Vantage Markets now

(Risk warning: Your capital can be at risk)

Test and review of the Vantage Markets trading platform

Like many other brokers, Vantage Markets offers MetaTrader 4 and 5 as trading platforms. This platform is available for every device. You can use your computer, browser, or mobile device. The MetaTrader has already been tested many times and is highly developed. It is one of the best trading platforms for traders. Our tests and experiences confirm this because we like to use the MetaTrader ourselves. In the following section, we will introduce you to the features and functions of the trading platform.

Offered trading platforms:

- MetaTrader 4

- MetaTrader 5

- Vantage Markets Mobile App

➔ Sign up for free with Vantage Markets now

(Risk warning: Your capital can be at risk)

Charting and analysis for successful trading

For charting, several ways of representation can be used. Also, additional add-ons or indicators can be added to improve the charting. The MetaTrader will be installed with a wide range of standard indicators. These are usually sufficient for a detailed analysis. On request, however, self-programmed tools can also be added to the software. This is not a problem because the MetaTrader is very functional.

There are enough drawing tools available for technical analysis. Whether horizontal or vertical lines. In this software, you will find everything you need to perform a professional analysis.

Facts of the MetaTrader 4/5:

- Indicators for trend and reversal trading

- Technical drawing tools

- Install add-ons and tools for free

- Multi-Charting

- Very fast execution

- User-friendly

- Available for any device

Mobile trading for any device

As mentioned above, the MetaTrader is very compatible. You only need single access for each device. With your account data, you can log in to any device. Mobile trading is indispensable today and is required by many traders. For example, react to the go-to exciting market news or simply control your portfolio. Positions can be opened and closed in a few seconds via smartphone.

Open your free account with Vantage Markets

The account opening process is straightforward with Vantage Markets. You can create your trading account in just a few steps. In the following section, we will guide you through the depot opening. After entering your personal data, the email address must be confirmed. In addition, the broker asks you to verify the account with appropriate documents before the first deposit.

The verification is similar to any other broker as well. To do so, upload a photo of proof of identity and proof of residence. The documents are usually confirmed under 24 hours (that’s how it was for me) and then all the functions of the trading account are available to you.

➔ Sign up for free with Vantage Markets now

(Risk warning: Your capital can be at risk)

Free and unlimited demo account

A demo account is a virtual balance account. Traders can thus trade on real terms and simulate real money trading without risk. It is, so to speak, “play money” which can be invested. The demo account is excellent for testing new strategies or markets. Even beginners or new customers can try the trading conditions and the broker’s offer. Vantage Markets offers a free demo account, which is also unlimited here. You can use it indefinitely and recharge it at any time.

Note:

The demo account is the best way to practice trading and improve investment results.

The minimum deposit and review of transactions of customer funds

Generally, the minimum deposit at Vantage Markets is $ 200. From this amount, a Standard STP account can be opened. You must deposit at least $ 500 for the RAW ECN account and at least $ 20,000 for the PRO ECN account. The capitalization of the trading account is elementary and works through proven methods.

Payment methods for the deposit:

- Credit Cards (Visa, Mastercard, American Express)

- Bankwire

- Skrill

- Neteller

- FasaPay

- Union Pay (China)

- Cryptocurrencies (Bitcoin, Ethereum, Litecoin)

➔ Sign up for free with Vantage Markets now

(Risk warning: Your capital can be at risk)

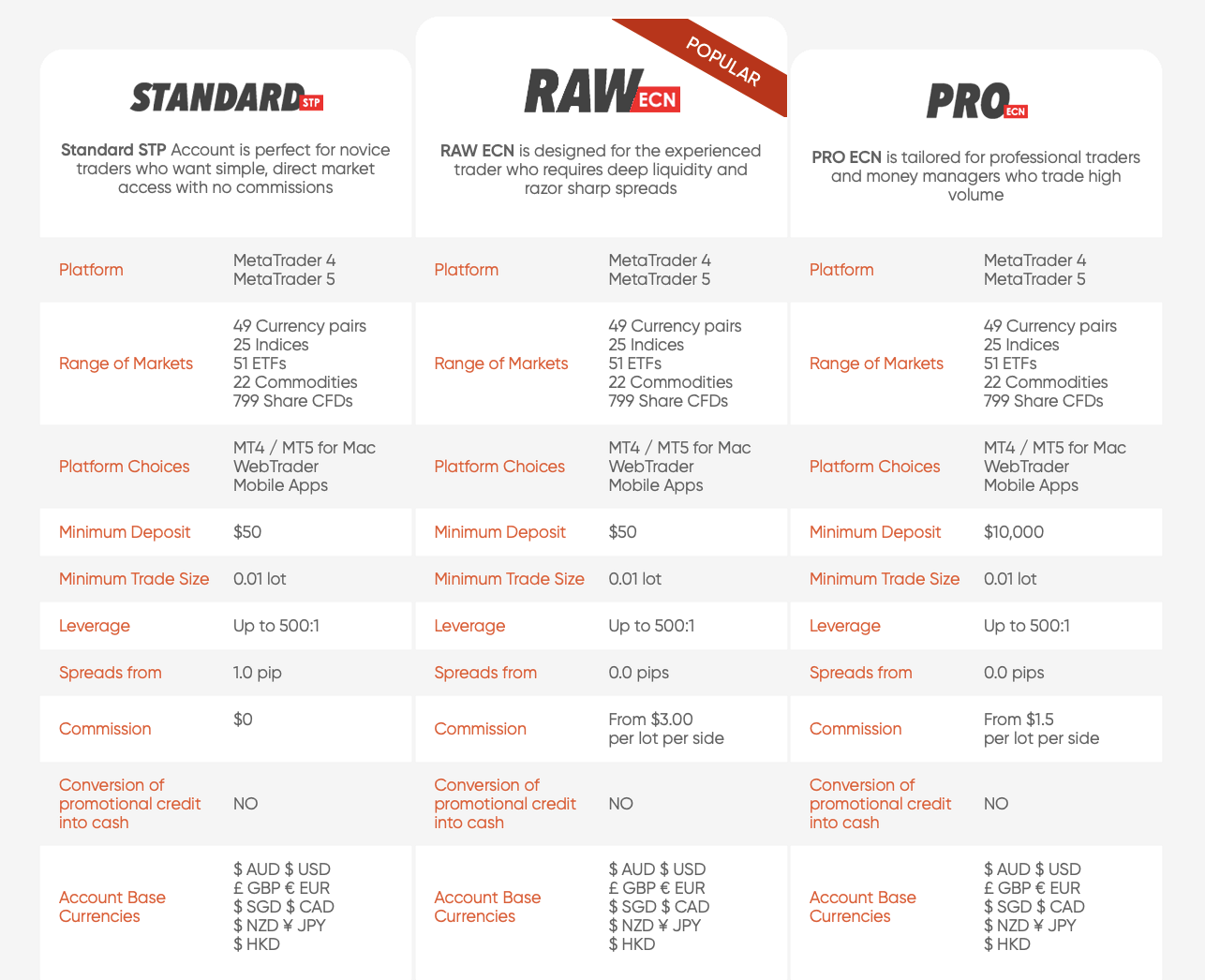

The different account types for traders

There are 3 different models available. The only difference is in the design and in the trading costs. Vantage Markets offers extremely low fees, especially for higher deposits. Higher trading volume allows the broker to earn more money and give you better terms. The following table provides more information about the characteristics of the different account models:

| STANDARD STP | RAW ECN | PRO ECN | |

|---|---|---|---|

| MIN. DEPOSIT: | $ 200 | $ 500 | $ 20,000 |

| EXECUTION: | STP | ECN | ECN |

| SPREADS: | 1.4 Pips + | 0.0 Pips + | 0.0 Pips + |

| COMMISSION: | No | $ 3 per 1 traded Lot (overall $ 6 per trade) | $ 2 per 1 traded Lot (overall $ 4 per trade) |

No conflict of interest because of ECN

Vantage Markets is undoubtedly not a market maker broker. This means that there is no conflict of interest between the broker and the trader. Some brokers only earn on the loss of traders and do not sell the orders to the markets. This is very untransparent in most cases. As you can see on the homepage of Vantage Markets, there is high transparency. The broker is a true ECN broker (see Liquidity Provider) and only earns on spread and paid trades commissions. An interesting conflict can be excluded.

Is there negative balance protection on Vantage Markets?

Stock market trading is risky, and an obligation to make additional payments cannot be suspended with a genuine ECN broker. If the market opens elsewhere and there is no liquidity to close or open your order, you will be given the next best price. In the worst case, this can lead to an additional funding obligation. The broker will automatically stop you if the margin is over-stimulated. With careful money management, a responsibility to make further payments can hardly happen. The not available negative balance protection only shows that Vantage Markets is a real ECN broker.

➔ Sign up for free with Vantage Markets now

(Risk warning: Your capital can be at risk)

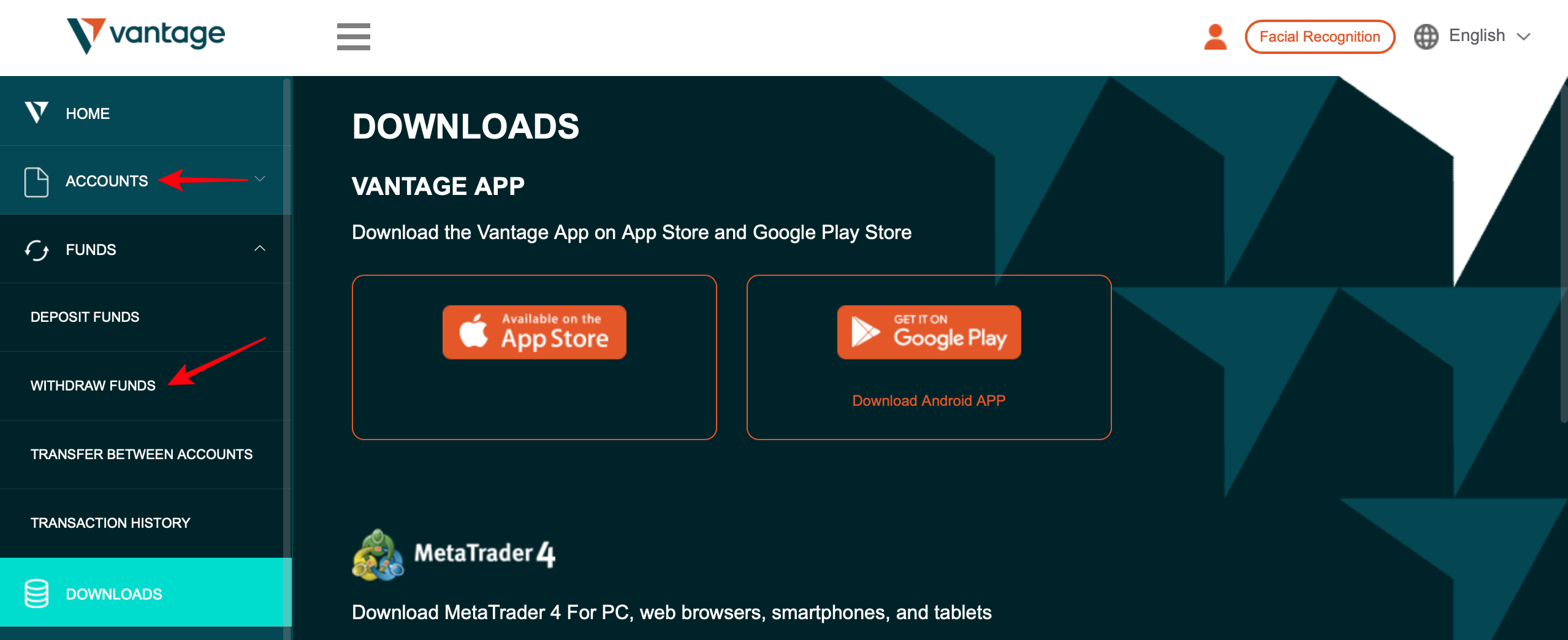

Our experience with the withdrawals

At Vantage Markets, you do not have to worry about the payout. Due to the regulations and licenses mentioned above, the broker is a very safe trading partner. The withdrawal works with the same methods as the deposit. Vantage Markets processes withdrawals every business day during regular working hours. Within 24 hours, the withdrawal should be executed during the week.

Another advantage of the broker is that there are no fees on the withdrawal. However, there may be fees charged by your personal bank for an international wire transfer. In summary, the withdrawal process works smoothly with this broker and is also free of charge! Another plus point for Vantage Markets.

- Payouts take a maximum of 3 days

- Within the week, withdrawals are processed within 24 hours

- No additional fees

In the client portal, click on “Funds” on the left side and then click on “Withdraw Funds”. After that, select the trading account, the amount, and the withdrawal method for the withdrawal. Enter all the details and confirm the withdrawal. See the picture below:

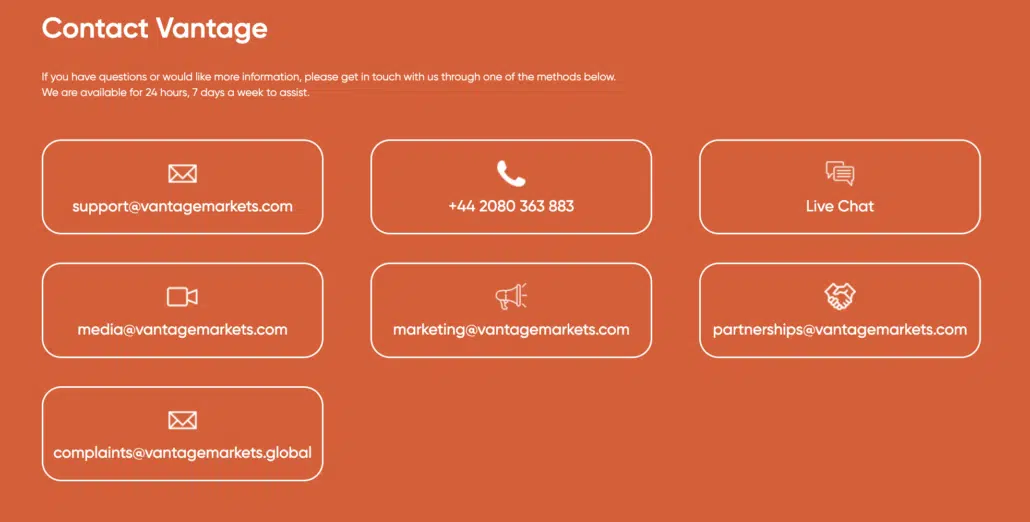

Vantage Markets support and service for traders

To allow a final verdict, the support and service for traders must also be tested. Trusted support is essential for most traders. It is also vital that you can close positions externally by phone or chat in emergency situations. Vantage Markets offers comprehensive support via phone, chat, or email. On weekdays, support is available 24 hours a day at the regular market opening hours.

Unfortunately, support is only available in English. The website has been translated into German, Chinese, Indonesian, and more. The support is in English, and other languages are missing. Still, you can only expect some supported languages from an Australian broker. From our experience, support for Vantage Markets is lightning fast. Especially over the chat, you get a speedy service.

Also, training for traders is available on the platform. Every day, analyses are published, and even webinars are held. The broker offers a complete package for the beginner or advanced trader. Another advantage is the support of the use of Teamviewer. In case of significant problems, the support can access your computer via external software (Teamviewer). This service is a real selling point of Vantage Markets. Overall, the support is doing very well for me. The service shows high professionalism and speed.

| Customer care number: | Email support: | Live chat: | Availability: |

| + 44(0)20 7043 5050 | support@vantagemarkets.co.uk | Yes, available | 24/5 |

The service of Vantage Markets:

- Support 24/5

- Phone, Chat, and Email

- 1-on-1 service and support

- Analysis and education center

➔ Sign up for free with Vantage Markets now

(Risk warning: Your capital can be at risk)

Conclusion of the Vantage Markets review: Professional online broker – No scam detected

In summary, Vantage Markets is among the best brokers out there. This company can be very interesting for beginners or advanced. In particular, the provider is recommended for traders who want transparent and secure trading.

The broker offers you the options you need for professional trading. From our experience, there are no disadvantages except the language barrier in English using the support. Vantage Markets is a reputable and trustworthy broker with an extensive and favorable trade offer for international traders.

If you need a high level of leverage and want to trade tight spreads, you should switch now or open your first trading account.

The advantages of Vantage Markets:

- Regulated and safe Forex Broker

- Real ECN Trading

- The best trading conditions for Forex

- Very fast execution

- Reliable support and service

- No hidden fees

- Low trading fees

- Supports MetaTrader 4/5

- Free bonus available

Vantage Markets Review

Overview and test of Vantage Markets

Trusted Broker Reviews

Regulation

Platform

Trading offers

Customer support

Deposit

Withdrawal

Summary

Vantage Markets is an excellent forex broker that offers real ECN trading and perfect trading conditions for forex trading.

5

From us, the broker gets a very good rating because he excludes its offer and the trading conditions 100% of other providers.  (5 / 5)

(5 / 5)

Trusted Broker Reviews

Experienced traders since 2013

➔ Sign up for free with Vantage Markets now

(Risk warning: Your capital can be at risk)

FAQs – The most asked questions about the broker Vantage Markets:

What is the Vantage Forex Broker’s minimum deposit/withdrawal amount?

The minimal deposit on Vantage Markets is $200, and the minimum withdrawal is $0.

The RAW ECN account requires at least $500 to open. Just keep in mind that you can start and maintain a live trading account having a $0 balance and that there are no account holding or maintenance fees. The minimum deposit is $50 for all future deposits.

Are there any fees for either deposits or even the withdrawals that customers make?

No, there aren’t any costs for deposits or even withdrawals.

Although deposits at Vantage Markets can be made for free with no fees incurred, some withdrawal processes have a cost.

In addition to Skrill, Neteller, BPay, Poli, credit cards, debit cards, and UnionPay transfers, Vantage Markets now accepts bank wire transfers, local bank transfers, and credit and debit cards.

All forms of payment have no additional costs for deposits; however, customers are still responsible for whatever fees their banks may levy. All withdrawal applications are processed Monday – Friday, 9 am to 7 pm (AEST), within a single business day.

How can I reach customer assistance at Vantage Markets?

Vantage Markets is legitimate because of its multi-award-winning customer service, which you may contact by phone, email, or live chat.

New York Stock Exchange

New York Stock Exchange Australian Stock Exchange

Australian Stock Exchange Toronto Stock Exchange

Toronto Stock Exchange Johannesburg Stock Exchange

Johannesburg Stock Exchange Bombay Stock Exchange

Bombay Stock Exchange New Zealand Stock Exchange

New Zealand Stock Exchange Nigerian Stock Exchange

Nigerian Stock Exchange Kenya Stock Exchange

Kenya Stock Exchange