Cryptocurrency

How to buy cryptocurrencies

Cryptocurrency has been the subject of intense debate in recent years. How many times have you heard stories of people losing hundreds of thousands of dollars to make money fast at the same time as people become millionaires overnight?

So, if you are planning to invest in cryptocurrency safely, this guide is for you. The purpose of this guide is to provide you with as much information as possible and to help reduce speculation in the marketplace. These non-recoverable and volatile cryptographic symbols will become unmanageable hard money worldwide. Crypto enthusiasts see a future where Bitcoin or other crypto coins will substitute euros, dollars, and more and create the world’s first free and fiat currency.

There are many reasons why people want to invest in cryptocurrency. Most people want to guarantee their capital against the collapse of the dollar, which will someday unavoidably happen. Another reason you may want to invest in cryptocurrency is that it supports the social vision of cryptocurrency, a free fiat currency for the whole world. You may also want to invest in crypto coins because you understand and love blockchain technology. Having said this, let’s start with the first thing you need to do to invest smartly.

What you should know before buying cryptocurrencies:

A few things you require as a new crypto investor include cryptocurrency accounts, personal identification documents, secure internet connection, and payment methods if using the KYC (Know Your Customer) platform. We also recommend keeping your personal wallet outside your Exchange account. Payment methods accepted using this route include bank accounts, debit cards, and credit cards. You can also obtain crypto coins through special machines and peer-to-peer exchanges. Nonetheless, from the beginning of 2020, bitcoin ATMs have increasingly requested government-issued IDs.

Privacy and security are important issues for crypto investors. Mentioning you have large crypto assets is not advisable, even though cryptocurrencies are not physical money. Anyone who discovers your private key can approve transactions, and you can lose your crypto coins. The private key must be kept confidential. When criminals find large assets, they can try to steal them. People can easily see the balance of any public address you utilize. Therefore, ensure you never save a huge investment in a public address that is not directly related to the address utilized for a transaction.

Anyone can view the history of transactions made on the blockchain. However, the transaction is publicly registered on the blockchain, but the user’s identity is not. On the Bitcoin blockchain, only the user’s public key is displayed next to the transaction, making the transaction confidential, but not anonymous. In some ways, bitcoin transactions are more transparent and traceable than cash, but cryptocurrencies can also be used anonymously.

Where can you buy and trade cryptocurrencies

Brokers

eToro is a choice for beginners thanks to its user-friendly platform and learning accounts that allow you to try and buy bitcoins without the risk of real money.

eToro was a pioneer in social media copy trading and was founded in Israel in 2006 as a technology developer for financial transactions. Since the launch of the first product, it has grown to serve over 9 million users through an innovative and constantly evolving platform, making it one of the world’s largest social trading platforms with customers in more than 170 countries.

Trade cryptocurrencies with the best conditions and a regulated broker:

eToro does not charge any fees for sending or receiving transactions. Blockchain fees are charged for sending and receiving. However, eToro charges a 0.1% conversion fee at the market price. Minimum withdrawals and fees are charged for each cryptocurrency type. The minimum bitcoin withdrawal is 0.0086 BTC and the withdrawal fee is 0.0005 units.

| PROS: | CONS: |

|---|---|

| An easy-to-use web platform suitable for bitcoin beginners | A 0.75% spread for buying bitcoin purchases and higher fees for other crypto coins |

| A free virtual currency training account worth $100,000 | |

| Copy the trading system and learn from other users |

If you are looking for a simple and specialized platform to buy bitcoins while learning more about the cryptocurrency ecosystem, eToro may be for you. Those new to bitcoin will appreciate the simple and easy platform and the CopyTrader system that allows you to imitate the trading of other platform participants.

eToro demo account:

When signing up, you can test your water with a $100,000 virtual account without risking real money. When you get comfortable, you can make real trades with real dollars.

Trade more than 100 different cryptocurrencies on professional platforms:

➔ The best alternative crypto platform: eToro – Open your free account

Risk warning: Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Robinhood

Robinhood doesn’t charge fees for buying or selling bitcoins. The platform is very similar to stock trading. However, it has few lists of supported currencies and there is no way to withdraw bitcoins into cryptocurrency wallets. If you pay 0.5% or more fees for buying and selling, you will lose most of your bitcoin revenue immediately. Robinhood is best known as a non-consignment stockbroker, but you can also buy and sell non-consigned bitcoins. If you already have experience investing in the stock market, you will probably be able to buy a cryptocurrency familiar with Robinhood. This is a bonus for those who are new to bitcoin.

What is Robinhood crypto?

Robinhood Crypto is a separate technology account used in conjunction with the Robinhood Equity investment account. It keeps a fairly short list of currencies, but can be suitable for many bitcoin buyers.

TradeStation

As a leader in trading technology, TradeStation provides support to off-the-cuff traders through its online trading platform. Active traders use the broker’s award-winning desktop platform. TradeStation Crypto allows you to buy, sell and exchange Bitcoin, Litecoin, Ethereum, Bitcoin Cash, and XRP. TradeStation Crypto serves both institutional and leisure customers.

TradeStation Crypto has a simple price structure. If your account balance is less than $100,000, you will be charged 0.50% manufacturer fee and 0.50% fee. If your account balance exceeds $100,000, the manufacturer’s fee will not be charged 0.25% or 0.125%, depending on the size of your account. For this fee, $1,000 worth of Bitcoin (BTC) is $5.

Trade more than 100 different cryptocurrencies on professional platforms:

➔ The best alternative crypto platform: eToro – Open your free account

Risk warning: Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Exchanges

Crypto Exchange is a digital marketplace that allows you to convert currencies such as US dollars to cryptocurrencies. Many exchanges that support Bitcoin also support other digital cryptocurrencies. The best cryptocurrency exchanges are safe, cost-effective, fast to install, easy to use, and have a variety of sources of funding. The best cryptocurrency exchanges for bitcoin trading in the United States offer three main advantages. Best of all, its solid security with two-factor authentication, cold storage, and a secure built-in wallet. Second, it is an easy-to-use website and platform. Third, it provides access to various cryptocurrency transactions such as Bitcoin and Ethereum. Here are the best places to buy cryptocurrency. Each Bitcoin exchange uses its own price and platform, so you can instantly be attracted to one exchange, not another.

Bitcoin exchanges connect buyers and sellers and in some cases act as intermediaries or intermediaries. When you buy bitcoin with a bitcoin wallet, the transaction is registered on the bitcoin blockchain, which publicly tracks bitcoin-based transactions. In some cases, the exchange may negotiate on your behalf and not send bitcoins to external digital wallets. Below are some exchanges that allow you to buy crypto:

Coinbase

If you are not familiar with the world of bitcoin and cryptocurrencies, Coinbase is a great place to start thanks to the support of many popular cryptocurrencies, a solid security record, and reasonable fees.

It is a recognized US leader with relatively long experience in the industry and more than 43 million consumer certifications; nonetheless, it stores most user assets in secure offline freezer storage. Coinbase is a large-scale cryptocurrency provider and exchange based in San Francisco. With over 43 million users in more than 100 countries, it is popular with crypto enthusiasts, investors and traders. Coinbase claims assets are over $90 billion and transactions are over $45 billion. You can trade dozens of currencies including Bitcoin on Coinbase.

Coinbase charges several pre-announced fees when initiating a transaction. This includes a fixed transaction fee and a spread of around 0.50%. The fee depends on the method of deposit and may be charged up to 3.99% for purchases with a bank card. Serious consumers may want to upgrade to Coinbase Pro, which uses its own pricing model.

What is Coinbase?

Coinbase offers solid security through Coinbase Vaults, two-factor authentication, and offline storage for most client assets.

Trade more than 100 different cryptocurrencies on professional platforms:

➔ The best alternative crypto platform: eToro – Open your free account

Risk warning: Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Gemini

Gemini is a licensed digital asset and management exchange founded in 2015 by the Winklevoss Twins and established for individuals and organizations. Gemini will allow users to buy, store and sell Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH) and ZCash (ZEC), as well as Gemini Dollars (GUSD) of the same name.

Coinmama

We chose Coinmama because the exchange offers instant bitcoin purchases with many payment methods and high limits. If you want to buy crypto and get credited immediately, and you previously own a crypto wallet, Coinmama may be the first place to start. Coinmama provides quick account sign-up and management. When you log in, you can purchase crypto coins instantly with multiple payment methods, but these instant purchase rights can be quite expensive.

You can purchase one of 10 currencies using your credit or debit card. When you place an order, Coinmama immediately checks the money on your contact card and then deposits the currency cryptocurrency into your cryptocurrency wallet. People in the UK and EU have additional instant financing options not available in the US.

Due to the nature of US bank transfers, this funding method cannot be purchased immediately, but we hope to add US ACH payments as a financing method. However, if you have a credit or debit card, and you don’t care about fees, Coinmama allows you to buy coins directly into your Bitcoin wallet.

Trade more than 100 different cryptocurrencies on professional platforms:

➔ The best alternative crypto platform: eToro – Open your free account

Risk warning: Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Kraken

Kraken uses a fee schedule with price incentives based on the volume of transactions over the past 30 days. For example, an average customer who trades for less than $50,000 per month pays a commission of $2.60 per $1,000 transaction. Marketers’ fees range from 0% to 0.16% and for participants from 0.10% to 0.26%. This system is more competitive than competitors like Coinbase and Gemini.

BlockFi

If you have a lot of cryptocurrencies and want to use it more without selling it, you need to know about BlockFi. BlockFi allows you to earn interest when depositing cryptocurrencies into your account. If you want to unlock bitcoins without selling, you can also use your existing cryptocurrencies as loan collateral, but keep an eye on the 3% to 9.3% interest rates and the 2% creative fees you need. You can also buy and sell bitcoins and other cryptocurrencies without additional transaction fees.

Early adoption of cryptocurrency or large holdings can lead to serious interest rates of up to 8.6% per year (as of February 2021). BlockFi also has a new credit card that pays in bitcoin, proof of the many innovations this unique cryptocurrency exchange can have.

Trade more than 100 different cryptocurrencies on professional platforms:

➔ The best alternative crypto platform: eToro – Open your free account

Risk warning: Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Bisq

We love Bisq’s decentralized ability to improve integrity and anonymity when it comes to buying and selling crypto coins through an open-source desktop app. For those who are fascinated by Bitcoin’s anonymity, Bisq has what you are looking for. Bisq is a decentralized exchange that does not require registration or calculations. That said, you can buy and sell almost honestly with Bisq. Essential Bisq applications are open source and free to use.

Bisq supports a variety of payment methods including bank transfer, Chase QuickPay, Popmoney, Zelle, and Western Union. Transaction fees vary from 0.05% to 0.70% depending on what you do and how you pay. Bisq is best suited for those with minimal cryptocurrency experience.

CEX.io

CEX.io is as easy to use and very secure as Coinbase and Coinmama! The best thing about CEX.io is that it is also an exchange. This means that when buying cryptocurrencies, you can trade them for other cryptocurrencies by buying and selling them on CEX.io. Another thing that sets CEX.io apart is that it accepts US dollars, euros, pounds, and rubles! CEX.io’s debit/credit card fee is 3.5% + $0.20. You can also use a bank transfer. You can buy Bitcoin, Ethereum, and DASH on CEX.io.

Trade more than 100 different cryptocurrencies on professional platforms:

➔ The best alternative crypto platform: eToro – Open your free account

Risk warning: Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Bitstamp

Established in 2011, Bitstamp is one of the oldest cryptocurrency exchanges. You can buy more cryptocurrencies on Bitstamp than on Coinbase. We accept bank and credit/debit card transfers in EUR and USD. This site is not recommended for beginners, as it is not as easy to use as Coinbase and Coinmama. In addition, high fees are required for small purchases by credit card.

The fee for using a debit card on Bitstamp is 2% if you deposit more than $1000 and $10 if you deposit less than $1000. I don’t recommend using Bitstamp to spend just $5! You can purchase Bitcoin, Ether, Litecoin, Bitcoin Cash, and Ripple on Bitstamp.

Trade cryptocurrencies with the best conditions and a regulated broker:

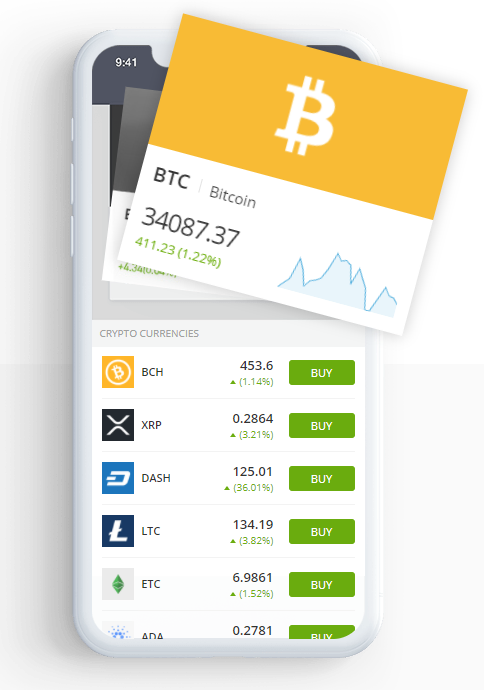

Buy crypto per app

Buying, selling, and storing cryptocurrency has never been easier. You can also shop on your smartphone. As more and more investors start to pay attention to cryptocurrency, the demand for fast and convenient mobile solutions continues to grow. Whether you are an Android user or prefer an iPhone, you can find a number of easy ways to get started with cryptocurrency. Cryptocurrency App is a mobile app that allows you to manage your cryptocurrency portfolio. When you start investing in cryptocurrency, it’s a good idea to invest your phone space in an app. Apps tend to be simpler to install and log in than on desktop platforms.

Here is a summary of the best cryptocurrency apps:

Coinigy

If you have experience in cryptocurrency trading, Coinigy is a great choice. This app allows you to trade on over 45 of the most popular cryptocurrency exchanges with just one account. Coinigy is available for desktop and mobile devices. It offers features such as unlimited transactions, high-resolution charts, and a variety of technical analysis tools. It supports both Android and iOS.

Binance

Binance is one of the most popular cryptocurrency exchanges in the world and the best app for buying cryptocurrencies. The app is easy to use, and the simple design is good for beginners. Not only can you buy and sell cryptocurrency, but you can also view cryptocurrency transaction history and savings. Features like a stop order, market orders, and final orders are available to experienced traders.

The app has a variety of alternative cryptocurrencies that can be used for transactions and recently introduced a fiat feature that allows you to buy bitcoins with a credit card. It supports Android and iOS.

Changelly

Changelly is a completely different application in that you can exchange one cryptocurrency for another cryptocurrency at a time. The app is easy to use and does not require lengthy account verification. When you transfer money from your wallet, Changelly will exchange it for the best price and charge you a 0.5% commission.

This application is convenient in that you do not have to wait for the deposit to be deposited. You can repair the course and wait for the exchange to complete. It contains over 140 cryptocurrencies that can be exchanged on the platform. It supports Android and iOS.

Coinbase

Coinbase is best suited for beginners who want to dive into the cryptocurrency game and learn more about what the industry has to offer. Coinbase is a great place to start your journey, even if you don’t know the difference between Bitcoin and blockchain.

Once verified, you can buy bitcoins with your bank or credit card account. Coinbase offers free cryptocurrency when you create a new topic in the education section. This app only supports 32 countries, but may expand to other countries in the future. It supports Android and iOS.

Trade more than 100 different cryptocurrencies on professional platforms:

➔ The best alternative crypto platform: eToro – Open your free account

Risk warning: Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Gemini

Gemini’s easy-to-use tools allow you to track market trends, build your crypto portfolio, and quickly execute your strategy. This app offers the best cryptocurrency exchanges and wallets. Gemini offers real-time pricing on the market anytime, anywhere. You can also set up price alerts to quickly buy and sell cryptocurrencies. If you want to take a long place in the cryptocurrency game, you can also set up repeat cryptocurrency purchases. The app is very easy to use, and you can create a free account in just a few minutes. It supports Android and iOS.

Step by step tutorial on how to buy cryptocurrencies

Step 1: choose a crypto exchange

Registering on a cryptocurrency exchange allows you to buy, sell, and store cryptocurrencies. In general, it is best to use an exchange that allows users to withdraw cryptocurrency into their personal online wallet for more secure storage. For individuals who want to trade bitcoin or other cryptocurrencies, this feature may not be of interest.

There are several types of cryptocurrency exchanges. Since Bitcoin’s ideology is about succession and individual sovereignty, some exchanges allow users to remain anonymous and do not require users to provide personal information. These exchanges operate independently and tend to be decentralized, so they do not have a central point of control. While these systems can be used for non-business activities, they are also used to serve the world’s non-banking population. For some categories of people (refugees or people living in countries with little public credit or banking infrastructure), you can return to the regular economy through anonymous exchanges.

However, currently, the most popular crypto exchanges are not distributed and require KYC. In the United States, these exchanges include Coinbase, Kraken, Gemini and Binance U.S. The number of features offered on each of these exchanges has increased significantly. Coinbase, Kraken, and Gemini offer bitcoins and a variety of altcoins. These three are probably the easiest ways to move to cryptocurrency across the industry. Binance is suitable for more advanced traders by offering more advanced trading features and choosing more altcoins to choose from.

Note:

When creating an account for a cryptocurrency exchange, it is important to remember how to be safe online. This includes the use of two-factor authentication and a unique long password consisting of lowercase, lowercase, letters, and special numbers.

Trade cryptocurrencies with the best conditions and a regulated broker:

Step 2: Link exchanges to payment methods

After choosing an exchange, you’ll be required to submit personal documents. Depending on the exchange, it may contain a picture of your driver’s license, your social security number, and information about your employer and the source of your funding. The information you need may vary depending on where you live and applicable laws. The process is similar to opening a normal broker account.

Once the exchange has verified your identity and legitimacy, you can now connect your payment method. On most exchanges, you can connect your bank account directly or connect a debit or credit card. You can buy cryptocurrency using a credit card, but in general, it should be avoided due to the volatility that cryptocurrencies can face.

Bitcoin is legal in the United States, but some banks don’t yet support the idea and may hesitate or block deposits on cryptocurrency-related websites or exchanges. It’s a good idea to check if your bank can deposit in the currency of your choice. Deposit fees vary by bank, debit, or credit card account. Coinbase is a stable starting exchange of 1.49% for bank accounts and 3.99% for debit and credit cards. It is important to research the fees for each payment option to help you choose an exchange or choose the payment option that works best for you.

Fee structure:

Crypto exchanges also charge transaction fees. This fee can be a fixed fee (if the transaction amount is low) or a percentage of the transaction amount. Treatment cards are required to pay a processing fee along with a transaction fee.

Trade more than 100 different cryptocurrencies on professional platforms:

➔ The best alternative crypto platform: eToro – Open your free account

Risk warning: Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Step 3: place an order

By choosing the relevant exchange and payment method, you can now buy bitcoins and other cryptocurrencies. Cryptocurrency exchanges have become increasingly popular in recent years. It has grown significantly in terms of liquidity and opportunity. An industry that was once considered a fraudulent or obscure development is slowly evolving into a legitimate industry that will be of interest to all major players in the financial sector.

Cryptocurrency exchanges have now reached a point where they have almost the same level of functionality as brokers. Find an exchange, connect your payment method, and you’re ready to go. Today, cryptocurrency exchanges offer many types of ordering and investment methods. Almost all cryptocurrency exchanges offer market orders and limit orders, some even offer stop-loss orders. Of the exchanges mentioned above, Kraken offers the most order types. Kraken allows you to set up a market, limit, stop loss, take profit and limit profit order.

In addition to the various types of orders, the stock exchange provides a way to set up recurring investments, allowing you to calculate the average dollar cost of the investments you choose. For example, Coinbase allows consumers to cancel daily, weekly, or monthly recurring purchases.

Trade more than 100 different cryptocurrencies on professional platforms:

➔ The best alternative crypto platform: eToro – Open your free account

Risk warning: Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Step 4: Secure storage

Bitcoin wallets and cryptocurrencies are a more secure place to store your digital assets. If cryptocurrency exists outside the crypto market and in your personal wallet, you can only control the private key to the money. It also gives you the opportunity to save money outside the crypto market, limit hacking on the crypto market, and avoid the risk of losing money.

Cryptocurrency wallets are where cryptocurrencies are purchased and then stored. You can compare cryptocurrency wallets and bank accounts. You store cryptocurrency in a cryptocurrency wallet just like you store traditional currencies (US dollars, yen, euros, etc.) in your bank account.

There are many easy-to-use and safe options to choose from. It is important to choose a wallet that is very secure, as cryptocurrency will never be recovered if it is stolen from your wallet.

There are three types of wallets.

- Internet Wallet: The fastest setup, but the lowest level of security

- Software wallet: downloadable application (more secure than an online wallet)

- Hardware Wallet: A portable device that connects to your computer via USB (the most secure option)

The wallet you need depends on the type of cryptocurrency you want to buy. For example, if you buy bitcoins, you need a wallet that can store bitcoins. If you buy Litecoin, you will need a wallet to store your Litecoin. Fortunately, there are many good wallets that can contain multiple cryptocurrencies. Exodus, for example, is a software wallet that allows you to store Bitcoin, Ethereum, Litecoin, Dash, EOS, and more!

Most exchanges offer wallets to users, but security is a key issue. It is generally not recommended to use a swap wallet for large or long-term cryptocurrency savings. Some wallets have more options than others. Some of them are dedicated to bitcoin and some offer the ability to store different types of altcoins. Moreover, some wallets also offer an option to exchange one token for another.

When choosing a bitcoin wallet, you have several options. The first thing you need to understand about cryptocurrency wallets is the concept of hot wallets (online wallets) and cold wallets (paper or hardware wallets).

Hot wallet

Online wallets are also known as hot wallets. A hot wallet is a wallet that runs on an internet-connected device such as a computer, phone, or tablet. These wallets can create vulnerabilities because they generate private keys for coins on these internet-connected devices. Hot wallets can be very convenient in that they allow you to quickly access and manipulate your assets, but keeping your private key on a device connected to the internet is more susceptible to hacking.

It may sound ridiculous, but people who don’t use enough security when using these hot wallets can steal money. This is not uncommon and can happen in a number of ways. For example, in public forums like Reddit, it’s not wise to brag about how many bitcoins you hold when security is weak and keep them in a hot wallet. However, these wallets can be secured if you take precautions. Strong passwords, two-factor authentication, and secure internet browsing should be considered minimum requirements.

This wallet is best used for small amounts of cryptocurrencies or altcoins that are actively traded on the stock exchange. You can compare hot wallets and checking accounts. From a financial point of view, only money normally used should be kept in a checking account and most of the money should be kept in other savings or investment accounts. The same goes for hot wallets. Threat wallets include mobile, desktop, web wallets, and wallets for storing swap accounts. As mentioned earlier, an exchange wallet is a custodian account provided by the exchange. Users of this type of wallet do not have private keys for cryptocurrencies stored in this wallet. You lose money when an exchange is hacked or an event occurs where your account is hacked.

Trade more than 100 different cryptocurrencies on professional platforms:

➔ The best alternative crypto platform: eToro – Open your free account

Risk warning: Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Cold wallet

The simplest explanation for a cold wallet is a wallet that has a much lower risk of hacking due to no internet connection. These wallets are also referred to as standalone wallets or hardware wallets. This wallet stores the user’s private key in an item that is not connected to the internet and comes with parallel execution software, allowing the user to view the portfolio without compromising the private key.

Perhaps the safest way to store cryptocurrency offline is to use a paper wallet. Paper wallets are wallets that can be created on certain websites. Then public and private keys are generated that you print on paper. The chance of accessing cryptocurrencies from these addresses is possible only if you have a piece of paper with a private key. Many people laminate this paper wallet to keep it in a safe storage box in a bank or in a safe at home. This wallet is designed to provide high security and long-term investment, as it is not possible to quickly sell or exchange the bitcoins stored in this way.

The most common type of cold wallet is a hardware wallet. A hardware wallet is usually a USB stick that safely stores a user’s private key offline. These wallets have significant advantages over hot wallets because they are not affected by viruses that may be present on your computer. In hardware wallets, private keys never come into contact with network computers or potentially vulnerable software. These devices are usually open-source, so instead of claiming that the society is safe for use in your company, you can make security decisions through code review.

Cold wallets are the safest way to store bitcoins or other cryptocurrencies. However, a little more information is required to set it up as a whole. A great way to set up a wallet is to have three things: a buy and sell swap account, a hot wallet to hold the small to medium-sized cryptocurrencies you want to sell or sell, and a cold hardware wallet to hold a larger amount.

How to deposit money

Brokerage exchanges are similar to currency exchanges that can be found at airports. However, instead of exchanging other local currencies together (e.g. yen to US dollars), you can exchange local currencies for cryptocurrencies. This is the easiest way to buy cryptocurrency. You can even make it with your phone! A cryptocurrency exchange is an online website that allows you to exchange local currencies for cryptocurrencies.

Payment methods:

Most exchanges accept bank or credit card payments, some also accept PayPal. You can choose between different exchanges. They all have different levels of security and each accepts different payment methods. Most exchanges require you to follow these steps before starting to buy cryptocurrency.

How to buy crypto with PayPal

You can also buy cryptos through the PayPal payment processor. There are two ways to buy bitcoins with PayPal. The first and most convenient way is to buy cryptocurrency with your PayPal account. The second option is to use your PayPal account balance to buy cryptocurrency from a third-party provider. This option is not as convenient as the first option, as there are few third-party websites where users can buy bitcoins with the PayPal button.

Four cryptocurrencies: Bitcoin, Ethereum, Litecoin, and Bitcoin Cash can be purchased directly through PayPal. Except for Hawaii, residents of each state can use an existing PayPal account or open a new account. To create a crypto account with PayPal, you will need your name, physical address, date of birth and tax registration number. There are many ways to buy bitcoins with PayPal.

Some of them:

- The current balance in your PayPal account

- A debit card linked to your PayPal account

- A bank account linked to your PayPal account

Credit cards cannot be used to purchase crypto coins through PayPal. During the purchase process, PayPal displays the price. However, the inherent volatility of cryptocurrency prices means that these prices can change rapidly. Make sure you have enough money in your account to complete the purchase.

When you buy bitcoin directly through PayPal, you earn money from the cryptocurrency spread or the difference in the market price of bitcoin and the exchange rate between the US dollar and the cryptocurrency. The company also charges a transaction fee for each purchase. This fee is based on the purchase amount (in dollars). For example, you will be charged a flat fee of $0.50 for purchases between $100 and $200. After that, the fee is a percentage of the total dollar. For example, if you buy a cryptocurrency between $100 and $200, you will be charged a fee equal to 2% of the total amount.

One of the downsides of buying cryptocurrency through PayPal is the inability to transfer cryptocurrency outside the payment processor platform. Therefore, you cannot transfer cryptocurrencies from your PayPal wallet to external cryptocurrencies or personal wallets. Another drawback of using PayPal is that online exchanges and merchants can use payment processors to make payments. eToro is one of the few online sellers who can use PayPal to buy bitcoins on the platform.

Trade more than 100 different cryptocurrencies on professional platforms:

➔ The best alternative crypto platform: eToro – Open your free account

Risk warning: Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

How to buy bitcoin with a credit card

Buying bitcoin with a credit card is similar to buying cryptocurrency using a debit card or direct debit (ACH). You will need to enter your credit card information and approve the transaction in the transaction or online trading company. However, it is generally not a good idea to buy bitcoins with a credit card. There are several reasons for this. First, not all crypto exchanges allow you to buy credit cards on bitcoin due to the associated processing fees and fraud risk. Their decision to do so can be in the best interests of their customers. This is because credit card processing may incur additional charges for these transactions. In addition to paying the transaction fee, you will also receive a processing fee that the exchange can pass on to you.

The second reason is that buying a credit card can be expensive. Credit card issuers see bitcoin purchases as a cash service and charge huge fees and interest on these loans. American Express and Chase, for example, are responsible for purchasing cryptocurrencies with withdrawal transactions. So, if you buy $100 worth of bitcoin with an American Express card, you’ll pay $10 (the current rate for these transactions) plus an annual interest rate of 25%.

An indirect way to buy bitcoins with a credit card is to get a bitcoin rewards credit card. This card works like a regular bonus credit card, except it offers bitcoin rewards. So they invest the money they get from their purchases into bitcoin. An example of a Bitcoin Rewards card is the BlockFi Bitcoin Rewards Credit Card. However, the annual fees for these cards can be high, and converting fiat money to cryptocurrency may incur additional costs.

Buying from exchanges:

Exchanges like Coinbase or Binance are still some of the most popular ways to buy bitcoins, but they’re not the only ones. Here are some of the additional processes used by bitcoin holders.

Bitcoin ATM

The bitcoin ATM machine acts as a private bitcoin exchanger. Individuals can deposit cash on a machine, use it to buy bitcoins, and then transfer them to a secure digital wallet. Bitcoin ATM machines are becoming more and more popular in recent years. The radar coin machine can help you track nearby machines.

P2P exchange

Unlike decentralized exchanges that facilitate all aspects of transactions anonymously to buyers and sellers, there are Peer-to-Peer (P2P) services that allow more direct communication between consumers. Local bitcoin is an example of such an exchange. Once the account is created, users can submit a request to buy or sell bitcoins, including payment method and pricing information. The trader then searches a list of buy and sell offers and selects a trading partner to close the deal.

Local Bitcoin facilitates certain aspects of trading. P2P exchanges do not offer the same anonymity as decentralized exchanges, but they allow consumers to trade at a better price. Most of these exchanges offer rating systems that allow consumers to rate potential trading partners before making a trade.

Buy or trade Crypto?

You can own a cryptocurrency unit or trade at cryptocurrency prices. When trading, you can use a derivative called a cryptocurrency CFD to guess the price without becoming an owner. For cryptocurrency units, you have to pay the full value of the asset. When shopping, you only need to install a small portion of the entire size of your website. This allows you to take a price-centered position while gaining more exposure than what is provided by the investment amount. This method can also be cheaper. For example, investors have no deposit or withdrawal fees to access the currency.

Trade offers more tax benefits than buying and holding You don’t have to pay for capital gains through cryptocurrency transactions, but if you profit directly from buying and selling cryptocurrencies, you do. On the other hand, the trading approach can increase your losses if your strategy goes wrong. To buy cryptocurrency, you have to buy and sell it through an exchange. This means you need to create an exchange account and store your cryptocurrency in your digital wallet.

To trade the only cryptocurrency, you only need a broker account, not direct access to the underlying crypto coin. The broker has access to the underlying market for you. It’s usually faster and easier to set up. Buying and holding cryptocurrency is useful if you want to use it for purchases or if you want to transfer money anytime, anywhere (faster than regular bank transfers) with a lower cost and a higher level of anonymity than traditional bank transfers.

To buy and hold a cryptocurrency, you first need to find a trusted exchange that is available in that country and offers a means of payment to purchase cryptocurrencies in fiat (US/Australian/Canadian dollars), euros, pounds. After purchasing virtual currency, you need to put it in a “wallet”, a program that can store it. Most exchanges have their own “wallets” that can be used by their customers, but using a wallet with access and full control is powerful.

Trade cryptocurrencies with the best conditions and a regulated broker:

Cryptocurrency buyers and owners are often considered simple and easy targets for hackers because their cryptocurrency transactions are final, there is no protection against fraud, and the fees provided by financial services are irreversible. Having coins in your wallet means you can keep your virtual coins until you sell them at a higher price later. At the same time, you are not charged for storage.

Trading cryptocurrencies with leveraged products such as CFDs means there are no coins and only uses the volatility of the cryptocurrency market. So, a cryptocurrency strategy is a short-term investment strategy that uses price changes to make quick returns without holding an underlying asset.

So ask yourself. Do you consider yourself an investor or speculator?

Both are aiming for maximum returns, but investors do not have the same trading strategies, risk recovery levels, and targets as speculators. In any case, the key to a successful investment is using a platform that fits your needs.

Exchanges appear to be riskier than CFD brokers, who are regulated and protect retailers. A broker can be valuable because it allows you to apply short-term trading strategies and appropriate money management rules in a flexible and controlled trading environment while enhancing your financial knowledge. You can increase your money by taking advantage of the protections offered to retailers through regulated, reliable, and secure brokers.

Cryptocurrency sales

You can sell bitcoins in the same places where you bought your cryptocurrencies, such as cryptocurrency exchanges and P2P platforms. The process of selling bitcoins on these platforms is generally similar to the process of buying cryptocurrencies. For example, in order for a sale to take place, you may need to click a button and enter the order type (i.e. if the cryptocurrency was sold immediately at a low price or sold to limit losses). Bitcoin offerings may vary depending on market composition and website demand.

Risks

Not only are there good reasons to invest in cryptocurrency, but there are also very few reasons to invest in cryptocurrency. A lot of people are experiencing the hype surrounding every cryptocurrency bubble. People always fall into the FOMO’s trap (fear of missing) and wants to make quick money by buying large amount of cryptos during the height of the bubble, but doesn’t fully understand cryptocurrency. This is a bad reason. Don’t do this, find out how to do it before investing.

Trading in cryptocurrency comes with high volatility. They are high and speculative, and it’s important to understand the risks before you start trading.

- There is high volatility: Unexpected changes in market sentiment can lead to sudden price fluctuations. It is not uncommon for cryptocurrencies to drop sharply to hundreds, if not thousands, of dollars.

- Unregulated: Cryptocurrencies are not currently regulated by governments or central banks. However, in recent years, it has begun to receive more attention. For example, I have a question about whether it should be classified as a virtual commodity or currency.

- Vulnerable to mistakes and hacking: There is no way to completely prevent technical errors, human errors, or hacking.

- May be affected by forks or closures: There are additional risks, such as hard forks or closed trading of cryptocurrencies. Before trading these commodities, you should be aware of these risks. If the hard fork rises, there can be significant price volatility around the event, and it can prevent trading throughout the event if there is no reliable price in the underlying market.

Be prepared to take the calculated risk

This is not a normal investment because the volatility of cryptocurrencies is much higher than that of other investment classes. In addition, there is always a risk that your country may ban cryptocurrency trading and exchanges. If so, you need to merge the crypto assets so that they don’t break. So the important thing here is to take as much money as you can afford.

Early investors in Bitcoin and Ethereum earned millions of dollars in net worth. For instance, from December 2016 to December 2017, Bitcoin has grown from a staggering $750 to $20,000! In fact, the total cryptocurrency market capitalization reached $630 billion at the end of 2017.

Stories like this are flooding the internet and more and more people have joined cryptocurrency ads for this piece of the crypto pie. However, as more and more speculators flooded the market, the inevitable happened. The market has plummeted. When bitcoin began to fall, all other currencies collapsed and many currencies lost their savings.

Trade more than 100 different cryptocurrencies on professional platforms:

➔ The best alternative crypto platform: eToro – Open your free account

Risk warning: Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Advantages and disadvantages of trading cryptos

If you are looking for a good investment opportunity, consider investing in cryptocurrency. It is very important to know the pros and cons of the cryptocurrency market before starting right now. Now looking at the pros and cons of investing in cryptocurrency, you can get an idea of what to expect.

Transparency

All transactions made in Bitcoin are tracked and registered on a public ledger called the blockchain. Once confirmed, the transaction cannot be changed. In addition, all cryptocurrency transactions have been verified and cannot be used by hackers or scammers.

24 hours available

You can trade cryptocurrency whenever you want. It doesn’t matter where you are. All you need is an internet connection. You can also trade with your mobile phone. Bitcoin can be a global form of currency because it is the easiest and fastest way of exchange available worldwide.

Under complete control

Bitcoin and cryptocurrency users have complete control over their funds and transactions and keep everything safe and anonymous. Not all transactions performed depend on the identity of an individual or party. No personal information is disclosed, which prevents fraud and identity theft. Because these cryptocurrencies are distributed, consumers do not have to rely on banks or other financial institutions to negotiate.

Significant potential for the price of asset to increase

Perhaps one of the greatest benefits of investing in Bitcoin or any other cryptocurrency is that it has tremendous potential for growth and acceptance. While many existing cryptocurrencies, including bitcoin, have come a long way, many cryptocurrency market analysts and experts believe that there is still a long way to go.

It may be more important for traders and investors to understand that small cryptocurrencies that are less well known may have greater potential for future returns, especially if they are often and widely used. The potential and room for growth of this appreciation entice many people to invest in the cryptocurrency market. However, it is important to remember that there are no guarantees in the cryptocurrency world.

Lost bitcoins cannot be recovered

Bitcoin and cryptocurrency can only be used in digital form and must be stored in a digital wallet. Digital wallets can be accessed with a personal access key. Unlike cryptocurrencies, traditional currencies stored in banks can be obtained if there is a problem with your account. However, since there is no central authority, you cannot use bitcoin and cryptocurrency. Losing your personal access key can result in permanent loss of your digital assets as there is currently no mechanism to recover the lost cryptocurrency.

It can be difficult to understand

The whole concept of a decentralized financial system stored with blockchain technology will be difficult for most people to understand. It is especially suitable for investors who do not know the principles of modern technology. For this reason, many potential investors choose not to trust the cryptocurrency market.

Market fluctuations

Like most markets, the cryptocurrency market is subject to fluctuations in market prices. As mentioned above, the crypto market is well known for its volatility. When investing in cryptocurrency, it is important not to think that you have made a bad investment due to changes in market prices. Think of it as a long-term investment as cryptocurrency is still in its infancy.

Trade more than 100 different cryptocurrencies on professional platforms:

➔ The best alternative crypto platform: eToro – Open your free account

Risk warning: Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Tips and tricks

Don’t Invest before you realize the risk

Even if you are good at cryptocurrency trading, the risks associated with cryptocurrency trading always exist. Therefore, you need to calculate the risk ratio and the degree to which it can adversely affect capital. Also, these traders can opt for this type of trading if the risk is well calculated, and you have positively agreed on the shoulder. As Warren Buffett once quoted, “Don’t say all the eggs in one basket”, invest in other currencies. This is very true for the cryptocurrency market. So, to avoid high risk, you should invest in other coins and not invest in just one coin.

Not all businesses can guarantee profits

Cryptocurrencies are somewhat similar to other CFDs, such as currencies or commodities, so there is the potential for losses and no one can promise a return on every trade. Avoid the fear and greed factors. Fear and greed are two emotional factors that must be addressed in every possible way because they are responsible for bad business. However, these factors cannot be eliminated.

Only buy and sell according to plan

Subscribe to popular newsletters. The phrase “no planning is a plan to fail” is a well-known phrase that also applies to the cryptocurrency market. To get good results in cryptocurrency trading, you need to carry out proper and accurate planning step by step.

Use of TP/SL risk reduction tools

Each platform has a risk reduction system that can compensate for risks and benefits. If you only buy cryptocurrency, you can stay or use it for your own purposes, but if you are trading for speculation, you need to specify the entry and exit points in the calculation. Following this will help improve and maintain the trading industry.

Follow a proven strategy

There are many strategies, but they all may not work as expected. So, you should choose the one that suits your investment opportunity and test it in a demo console or simulator. Once your strategy is tested, you can think about implementing it in your live account.

Trade more than 100 different cryptocurrencies on professional platforms:

➔ The best alternative crypto platform: eToro – Open your free account

Risk warning: Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Popular cryptocurrencies

Bitcoin

Bitcoin is the first intuitive application of blockchain technology, a standalone ledger for time trading allocated to all network participants, and is currently used by many applications.

Bitcoin-based blockchain allows holders to send and receive money without the intervention of third parties such as banks or payment service providers.

Reason to buy

+ Good Support + Transparent + Anonymous + Extensive Support

Ether (Ethereum)

Ethereum blockchain network introduces the concept of decentralized applications that take advantage of the decentralized nature of the network and serve as the basis for building a thriving DeFi and NFT marketplace. Ether (ETH) is the cryptocurrency that underlies the Ethereum network known as the “world computer”.

Ethereum was launched in 2015 and adopted a Bitcoin-cited public blockchain model, adding the ability to encode automated contracts (called smart contracts) that run automatically when a set of parameters is met.

Reason to buy

+ Great variety of features + Strong community

Monero

This is a cryptocurrency for those who care about privacy. Monero (XMR) is a cryptocurrency designed to make transactions impossible, making it a solid alternative for anyone who prioritizes privacy. Unlike Bitcoin and Ether, which are on top of a public and completely transparent block, Monero uses cryptography to send and receive addresses as well as hide transaction costs.

Reason to buy

+ High level of transaction integrity + Privacy design

Litecoin

Best cryptocurrency in terms of transaction speed. Bitcoin is undoubtedly the most popular cryptocurrency, but it comes at a cost to the level of network traffic and how it is built: low transaction speed. Litecoin (LTC), created from a copy of the Bitcoin blockchain, was specifically designed to solve this problem and outperforms Bitcoin by almost four times in transaction capacity.

Although both have very similar architectures, Litecoin is designed to allow more transactions to traverse the network over a period of time using a completely different hashing algorithm for mining.

Reason to buy

+ High-Speed Trading + Reputation

Tether

Tether (USDT) differs from the other cryptocurrencies on this list in that they are not subject to the same level of market volatility.

Like stable coins (especially fixed with fiat support), Tether is tied to fixed assets. In this case, there is a USD reserve for each unit of Tether in circulation, which means that the price of the cryptocurrency is equal to the exact price of the fiat currency.

Reason to buy

+ Fixed price + suitable for payment

Conclusion: Cryptocurrencies can be a good investment or hedge

You may still be wondering if you should invest in cryptocurrency. We think the benefit outweighs the risk, but even so, it should depend on your intentions. Cryptocurrency is used by many as a separate source of income from trading or investment, but currently few people use cryptocurrency for purchases. The value of cryptocurrencies has increased over time and will continue to increase in the future. If you can invest in cryptocurrency today, you can understand that it is a smart investment for the future.

Trade more than 100 different cryptocurrencies on professional platforms:

➔ The best alternative crypto platform: eToro – Open your free account

Risk warning: Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

FAQ – The most asked questions about How to buy cryptocurrencies :

What is the best method for purchasing cryptocurrency?

If you are searching for the best and most popular way to exchange and purchase cryptocurrency, you must try Coinbase. The reason is you can directly invest in US Dollars. As of now, you can purchase Litecoin, Bitcoin, Ethereum, and more than 30 other digital coins and tokens on the platform.

How to buy cryptocurrency for Beginners?

Beginners can easily buy cryptocurrency with the help of crypto exchange, or you can also use certain broker-dealers. However, make sure to keep a check on the transaction fees as if varies widely with different currencies. Investing in cryptocurrency can surely give large returns, but as a beginner, you must take special care of how much money you are investing. Never put money into investments that you cannot stand to lose.

What are the steps to legally buy cryptocurrency?

To legally buy cryptocurrency, you first need to download the WazirX app. After installing the app, fill up your bank account details and do the KYC. This will help them to verify you as a client and your trading account. After completion of this step, you can add funds through any payment gateway like IMPS, NEFT, RTGS, or UPI.

Is it difficult to buy cryptocurrency?

Investment may seem tough until you do not start investing. When you will understand the investment tricks and break the procedure into small steps, it will be a cakewalk for you.

Top Online Brokers for Buying and Selling Cryptocurrency in 2023

What are cryptocurrencies and how you can put money into them?

If you have not heard of Bitcoin but, it is time to delve into the world of this cryptocurrency that’s gaining growing prominence within the monetary realm. Bitcoin is a decentralized digital foreign money, which suggests it’s not managed by any authorities or monetary establishment. This means which you could ship and obtain Bitcoins with out the necessity for intermediaries reminiscent of banks or exchanges.

Cryptocurrencies are digital or digital currencies that make the most of cryptography for safety and function independently of central banks or governments. They’re constructed on blockchain know-how, which is a decentralized ledger that information all transactions and ensures transparency.

Investing in cryptocurrencies will be achieved by way of the next steps:

- Educate Your self: Begin by gaining a strong understanding of how cryptocurrencies work, their potential advantages, and related dangers. Analysis completely different cryptocurrencies and their use circumstances to make knowledgeable funding choices.

- Select a Dependable Change: Choose a good cryptocurrency trade that provides a variety of cryptocurrencies for buying and selling. Search for exchanges with strong safety measures, user-friendly interfaces, and good buyer assist.

- Set Up an Account: Create an account on the chosen cryptocurrency trade and full the required verification course of. This usually entails offering identification paperwork and proof of tackle.

- Safe Your Pockets: Arrange a cryptocurrency pockets to retailer your digital belongings securely. Wallets will be hardware-based (bodily units), software-based (desktop or cell functions), or on-line/cloud-based. {Hardware} wallets typically provide the best stage of safety.

- Resolve on an Funding Technique: Decide your funding targets, whether or not short-term buying and selling or long-term holding. Contemplate components reminiscent of danger tolerance, funding timeframe, and diversification. Some widespread funding methods embrace dollar-cost averaging, swing buying and selling, and hodling (holding for the long run).

- Carry out Analysis and Evaluation: Conduct thorough analysis on the cryptocurrencies you want to put money into. Analyze their market traits, historic worth efficiency, mission groups, partnerships, and general adoption potential. Keep up to date on trade information and regulatory developments that will influence your investments.

- Implement Threat Administration: Allocate solely a portion of your funding capital to cryptocurrencies and diversify your portfolio throughout completely different cryptocurrencies to mitigate dangers. Set stop-loss orders or make use of different danger administration methods to guard your investments from important losses.

- Make Your First Funding: After you have chosen a cryptocurrency and performed your evaluation, use the funds in your trade account to buy the specified cryptocurrency. Comply with the trade’s directions for executing trades.

- Monitor and Regulate: Repeatedly monitor your investments and keep knowledgeable about market traits. Contemplate adjusting your funding technique based mostly on altering market situations and your funding targets.

- Keep Safe: Be vigilant about cybersecurity. Use robust, distinctive passwords to your trade and pockets accounts, allow two-factor authentication, and watch out for phishing makes an attempt and suspicious web sites.

Do not forget that investing in cryptocurrencies carries inherent dangers, together with worth volatility and regulatory uncertainties. It is advisable to seek the advice of with a monetary advisor earlier than making any funding choices.

Unveiling the Fascinating World of Cryptocurrencies

For those who’re searching for an progressive and thrilling technique to make investments your cash, cryptocurrencies will be the reply you have been trying to find. Cryptocurrencies symbolize a type of digital foreign money that’s quickly gaining reputation worldwide. On this article, we are going to make clear what cryptocurrencies are and how one can put money into them.

Understanding Cryptocurrencies

Cryptocurrencies are digital currencies that make the most of cryptography to safe transactions and management the creation of recent models of the foreign money. Not like conventional currencies such because the US greenback or the euro, cryptocurrencies are usually not issued by governments or monetary establishments. As a substitute, they’re created by way of a course of often called mining.

Unraveling the Inside Workings of Cryptocurrencies

Cryptocurrencies function on a decentralized community often called the blockchain. The blockchain serves as a digital ledger that maintains a file of all transactions made with a selected cryptocurrency. Every transaction is verified by a community of computer systems relatively than a centralized monetary establishment.

Exploring Completely different Sorts of Cryptocurrencies

There’s all kinds of cryptocurrencies out there in the marketplace, every with its distinctive traits and applied sciences. Among the most well-known cryptocurrencies embrace Bitcoin, Ethereum, Litecoin, and Ripple. Every of those cash has its personal historical past and goal, and it’s important to grasp the variations between them earlier than investing.

Discovering the Advantages of Investing in Cryptocurrencies

Investing in cryptocurrencies can carry quite a few benefits, together with the potential for prime returns in a comparatively quick interval. Furthermore, cryptocurrencies are immune to inflation since their worth is decided by provide and demand relatively than authorities insurance policies. Lastly, cryptocurrencies present an accessible and international funding alternative, permitting people from all around the globe to take part.

Easy methods to Purchase Cryptocurrencies?

Buying cryptocurrencies is comparatively easy. You should buy cryptocurrencies on a cryptocurrency trade, a web-based buying and selling platform that facilitates the shopping for and promoting of digital currencies. Moreover, cryptocurrencies will be acquired from cryptocurrency ATMs or immediately from different people.

Ideas for Safe Cryptocurrency Investing

Whereas investing in cryptocurrencies will be thrilling and worthwhile, it’s essential to take precautions to make sure the protection of your investments. Ensure to make use of a good and safe cryptocurrency trade when shopping for cryptocurrencies. Moreover, retailer your cryptocurrencies in a safe pockets and often replace your software program.

The Dangers of Cryptocurrency Investing

Though investing in cryptocurrencies will be extremely profitable, it additionally comes with its share of dangers. Cryptocurrencies are extremely unstable, and their worth can fluctuate quickly inside a brief interval. Moreover, cryptocurrencies could also be focused by hackers and different criminals, which may end up in the lack of funds.

The Way forward for Cryptocurrencies: What to Count on

The way forward for cryptocurrencies stays unsure, however many specialists imagine they’ve the potential to remodel the way in which folks have interaction with cash. Cryptocurrencies can facilitate worldwide transactions and scale back related prices. Furthermore, cryptocurrencies can be utilized to create new enterprise fashions and monetary merchandise.

Embrace Cryptocurrency Investing and Be part of the Monetary Revolution!

Cryptocurrencies are reshaping the way in which we take into consideration cash and investments. By investing in cryptocurrencies, you may turn into part of this thrilling monetary revolution. Make sure you perceive the dangers and advantages earlier than investing and begin exploring the world of cryptocurrencies at present.

Embrace the Revolution: Put money into Cryptocurrencies and Form the Future

Cryptocurrencies have ushered in a brand new period, reworking our notion of cash and investments. Their decentralized nature and progressive know-how provide unparalleled alternatives for many who dare to embrace the revolution. On this article, we are going to delve deeper into the fascinating world of cryptocurrencies, highlighting the potential rewards and the trail to funding.

The Rise of Cryptocurrencies

Cryptocurrencies have emerged as a groundbreaking type of digital foreign money, difficult conventional monetary programs. Powered by blockchain know-how, they supply safe and clear transactions, free from the management of central banks and intermediaries. The worldwide adoption of cryptocurrencies displays the rising demand for monetary autonomy and a extra inclusive economic system.

The Promise of Blockchain

On the coronary heart of cryptocurrencies lies the revolutionary blockchain know-how. A decentralized and immutable ledger, the blockchain ensures belief and integrity in each transaction. This transformative know-how not solely fuels cryptocurrencies but additionally holds the potential to revolutionize varied industries, together with finance, provide chain administration, and digital id verification.

Numerous Cryptocurrencies: Exploring the Panorama

The world of cryptocurrencies is wealthy and various, providing a spread of choices past the famend Bitcoin. Ethereum, with its sensible contract capabilities, opens doorways to decentralized functions and programmable finance. Ripple focuses on environment friendly cross-border transactions, whereas Litecoin gives sooner transaction affirmation instances. Familiarize your self with the distinctive options and targets of various cryptocurrencies to make knowledgeable funding choices.

Seizing the Alternative: Investing in Cryptocurrencies

Investing in cryptocurrencies presents an exhilarating alternative for each seasoned buyers and newcomers alike. To enter this area, one should select a good cryptocurrency trade that aligns with their funding targets. Cautious analysis, understanding market traits, and diversification of holdings are key methods for profitable cryptocurrency funding. As with every funding, it is important to think about the related dangers and train warning.

Navigating the Volatility

Cryptocurrencies are famend for his or her volatility, with costs fluctuating dramatically inside quick intervals. This volatility presents each alternatives and dangers. Whereas it permits for the potential of great returns, it additionally requires disciplined danger administration and a long-term funding perspective. It’s prudent to allocate an quantity you might be comfy with and be ready for worth fluctuations alongside the way in which.

Safeguarding Your Investments

Defending your cryptocurrency investments is paramount on this digital panorama. Choosing a safe pockets, whether or not hardware-based or software-based, is crucial to safeguard your digital belongings. Enabling two-factor authentication and sustaining robust safety practices, reminiscent of utilizing distinctive and complicated passwords, provides an extra layer of safety in opposition to potential threats.

Embracing Regulatory Developments

As cryptocurrencies achieve mainstream acceptance, regulatory frameworks are evolving to offer investor safety and foster market stability. Hold abreast of the newest regulatory developments in your jurisdiction to make sure compliance and reduce authorized and monetary dangers. Participating with licensed and controlled exchanges additional enhances your funding safety.

The Future Unveiled: A Paradigm Shift

The way forward for cryptocurrencies is laden with transformative potential. As extra industries and people acknowledge their advantages, cryptocurrencies are poised to disrupt conventional monetary programs additional. They maintain the promise of better monetary inclusion, streamlined cross-border transactions, and the democratization of entry to capital. By investing in cryptocurrencies, you turn into an energetic participant in shaping this new monetary panorama.

Seize the Second: Enterprise into Cryptocurrencies At present

The world of cryptocurrencies beckons, providing a gateway to thrilling funding alternatives and an opportunity to redefine the way forward for finance. Educate your self, search steerage from respected sources, and train prudence as you embark on this thrilling journey. Embrace the revolution, and collectively, allow us to form a extra inclusive and decentralized monetary world.

Record of the most important Cryptocurrencies At present

Here’s a listing of the highest 50 principal cryptocurrencies by market capitalization as of the time of writing:

- Bitcoin (BTC)

- Ethereum (ETH)

- Binance Coin (BNB)

- Cardano (ADA)

- XRP (XRP)

- Dogecoin (DOGE)

- Polkadot (DOT)

- Bitcoin Money (BCH)

- Chainlink (LINK)

- Litecoin (LTC)

- Web Pc (ICP)

- Bitcoin SV (BSV)

- Polygon (MATIC)

- Ethereum Basic (ETC)

- Stellar (XLM)

- VeChain (VET)

- Filecoin (FIL)

- TRON (TRX)

- Aave (AAVE)

- Cosmos (ATOM)

- Monero (XMR)

- EOS (EOS)

- Neo (NEO)

- Algorand (ALGO)

- Terra (LUNA)

- Solana (SOL)

- Klaytn (KLAY)

- BitTorrent (BTT)

- Tezos (XTZ)

- FTX Token (FTT)

- Huobi Token (HT)

- Avalanche (AVAX)

- Compound (COMP)

- IOTA (MIOTA)

- PancakeSwap (CAKE)

- Theta Community (THETA)

- The Graph (GRT)

- SushiSwap (SUSHI)

- Crypto.com Coin (CRO)

- Synthetix (SNX)

- Maker (MKR)

- Neo (NEO)

- Celsius Community (CEL)

- 1inch (1INCH)

- Dai (DAI)

- Waves (WAVES)

- Elrond (EGLD)

- Hedera Hashgraph (HBAR)

- Enjin Coin (ENJ)

- Decentraland (MANA)

Please observe that the rankings could range over time because the cryptocurrency market is extremely dynamic.

- Bitcoin (BTC): Bitcoin is the primary and most well-known cryptocurrency. It goals to be a decentralized digital foreign money, permitting safe peer-to-peer transactions with out the necessity for intermediaries.

- Ethereum (ETH): Ethereum is a decentralized platform that allows the creation and execution of sensible contracts and decentralized functions (DApps). It has its personal cryptocurrency referred to as Ether, which serves because the gasoline for these operations.

- Binance Coin (BNB): Binance Coin is the native cryptocurrency of the Binance trade, one of many largest cryptocurrency exchanges globally. It gives varied advantages to customers, together with discounted buying and selling charges and participation in token gross sales on the Binance platform.

- Cardano (ADA): Cardano is a blockchain platform that goals to offer a safe and scalable infrastructure for the event of decentralized functions. It focuses on educational analysis, formal verification, and a layered structure to make sure excessive ranges of safety.

- XRP (XRP): XRP is a digital asset that works as each a cryptocurrency and a know-how for quick and low-cost worldwide cash transfers. It was created by Ripple Labs and is utilized by monetary establishments to facilitate cross-border transactions.

- Dogecoin (DOGE): Dogecoin began as a meme cryptocurrency however has gained a major following. It has a pleasant and enjoyable group and is usually used for tipping on-line content material creators. Regardless of its origins, it has grown in worth and recognition.

- Polkadot (DOT): Polkadot is a multi-chain platform that allows completely different blockchains to interoperate and share info securely. It goals to create a decentralized web the place completely different blockchain networks can talk and collaborate seamlessly.

- Bitcoin Money (BCH): Bitcoin Money is a cryptocurrency that emerged from a tough fork of Bitcoin. It goals to deal with scalability points by growing the block measurement, permitting for sooner and cheaper transactions in comparison with Bitcoin.

- Chainlink (LINK): Chainlink is a decentralized oracle community that connects sensible contracts with real-world knowledge and exterior APIs. It permits sensible contracts to entry and work together with off-chain knowledge, increasing their capabilities.

- Litecoin (LTC): Litecoin is also known as the “silver to Bitcoin’s gold.” It shares many similarities with Bitcoin however gives sooner block era instances and a distinct hashing algorithm, making it extra environment friendly for on a regular basis transactions.

- Web Pc (ICP): Web Pc is a blockchain platform that goals to create a decentralized web. It permits builders to construct and host web sites, companies, and functions on the blockchain, eliminating the necessity for conventional internet servers.

- Bitcoin SV (BSV): Bitcoin SV stands for “Bitcoin Satoshi Imaginative and prescient” and emerged on account of a tough fork from Bitcoin Money. It goals to revive the unique imaginative and prescient of Bitcoin as outlined in Satoshi Nakamoto’s whitepaper.

- Polygon (MATIC): Polygon, beforehand often called Matic Community, is a layer 2 scaling resolution for Ethereum. It goals to enhance scalability and usefulness by offering sooner and cheaper transactions, making Ethereum extra accessible to builders and customers.

- Ethereum Basic (ETC): Ethereum Basic is a continuation of the unique Ethereum blockchain after a contentious arduous fork. It adheres to the precept of immutability and goals to offer a platform for decentralized functions and sensible contracts.

- Stellar (XLM): Stellar is a blockchain-based platform designed for quick and low-cost cross-border funds. It facilitates the issuance and switch of digital belongings, making it simpler for monetary establishments and people to take part within the international economic system.

- VeChain (VET): VeChain is a blockchain platform centered on provide chain administration and product authenticity verification. It permits companies to trace and confirm the origin, high quality, and authenticity of merchandise utilizing blockchain know-how.

- Filecoin (FIL): Filecoin is a decentralized storage community that permits customers to lease out their unused space for storing and earn Filecoin tokens in return. It goals to create a extra environment friendly and resilient storage infrastructure utilizing blockchain know-how.

- TRON (TRX): TRON is a blockchain-based platform that focuses on content material sharing and leisure functions. It goals to offer a decentralized ecosystem for content material creators and customers, bypassing intermediaries and enabling direct peer-to-peer transactions.

- Aave (AAVE): Aave is a decentralized lending and borrowing platform constructed on the Ethereum blockchain. It permits customers to lend their cryptocurrencies and earn curiosity or borrow belongings through the use of their current holdings as collateral.

- Cosmos (ATOM): Cosmos is a community of interconnected blockchains that allows seamless communication and interoperability between completely different blockchain networks. It goals to resolve the problem of blockchain fragmentation and promote scalability and compatibility.

- Monero (XMR): Monero is a privacy-focused cryptocurrency that prioritizes person anonymity and untraceability. It makes use of superior cryptographic strategies to make sure privateness in transactions, making it troublesome to hint or determine the events concerned.

- EOS (EOS): EOS is a blockchain platform designed for decentralized functions and sensible contracts. It goals to offer scalability and adaptability by using a delegated proof-of-stake consensus mechanism and parallel processing.

- Neo (NEO): Neo, also known as the “Chinese language Ethereum,” is a blockchain platform that allows the event of decentralized functions and sensible contracts. It emphasizes digital asset possession, digital id, and regulatory compliance.

- Algorand (ALGO): Algorand is a scalable and safe blockchain platform that goals to offer quick and environment friendly decentralized options. It makes use of a pure proof-of-stake consensus mechanism, enabling quick transaction affirmation and excessive scalability.

- Terra (LUNA): Terra is a stablecoin-focused blockchain platform that goals to offer price-stable digital currencies for on a regular basis use. It achieves stability by pegging its stablecoins to varied fiat currencies or belongings, providing stability and comfort for customers.

- Solana (SOL): Solana is a high-performance blockchain platform designed for decentralized functions and crypto tasks. It boasts quick transaction speeds and low charges, aiming to facilitate scalable and environment friendly decentralized functions.

- Klaytn (KLAY): Klaytn is a blockchain platform developed by Kakao, a significant South Korean web firm. It goals to offer a user-friendly setting for blockchain-based companies and focuses on selling mass adoption of blockchain know-how.

- BitTorrent (BTT): BitTorrent, created by the TRON basis, makes use of blockchain know-how to decentralize file-sharing and enhance community effectivity. It incentivizes customers to share recordsdata with the BTT token, rewarding members for his or her contributions.

- Tezos (XTZ): Tezos is a blockchain platform that provides self-amendment and on-chain governance. It permits stakeholders to vote on proposed protocol upgrades, guaranteeing the community’s evolution and flexibility with out the necessity for arduous forks.

- FTX Token (FTT): FTX Token is the native cryptocurrency of the FTX trade, a number one cryptocurrency derivatives platform. It gives varied advantages to customers, together with price reductions, participation in token gross sales, and voting rights throughout the FTX ecosystem.

- Huobi Token (HT): Huobi Token is the native cryptocurrency of the Huobi trade, one of many largest cryptocurrency exchanges globally. It gives advantages reminiscent of price reductions, entry to unique occasions, and participation in token gross sales on the Huobi platform.

- Avalanche (AVAX): Avalanche is a blockchain platform that focuses on scalability and velocity. It goals to offer a extremely environment friendly community for decentralized functions and permits builders to create customized blockchains throughout the Avalanche ecosystem.

- Compound (COMP): Compound is a decentralized lending protocol constructed on the Ethereum blockchain. It permits customers to lend or borrow cryptocurrencies and earn curiosity or pay borrowing charges based mostly on provide and demand dynamics.