How to Buy Amazon Stock: A Quick Guide

Amazon is without doubt one of the world’s most precious firms, identified for its various vary of merchandise and speedy progress within the e-commerce and tech industries. With a strong monetary basis and a fame for innovation and disruption, investing in Amazon inventory generally is a profitable alternative for long-term traders in search of excessive returns.

Shopping for Amazon shares is less complicated than ever, due to the rising variety of on-line brokerage platforms and funding instruments accessible to retail traders. On this fast information, we’ll stroll you thru the method of shopping for Amazon inventory, highlighting key metrics and evaluation to contemplate, and sharing skilled ideas and techniques that can assist you benefit from your investments.

Key Takeaways

- Investing in Amazon inventory affords the potential for top returns over the long run

- Researching key metrics reminiscent of monetary ratios, income progress, and market traits is essential when contemplating buying Amazon shares

- Selecting a dependable brokerage platform may also help guarantee a clean shopping for course of and reduce charges

- Understanding dividends and capital positive factors is significant for maximizing funding returns

- Steady analysis and evaluation are important to staying knowledgeable and making knowledgeable funding selections

Understanding Amazon Inventory: Why Put money into Amazon?

Investing in Amazon inventory generally is a sensible determination because of the firm’s regular progress and powerful market efficiency. Amazon’s entrance into varied industries reminiscent of leisure, healthcare, and promoting makes it a extremely diversified and progressive firm with a large market enchantment.

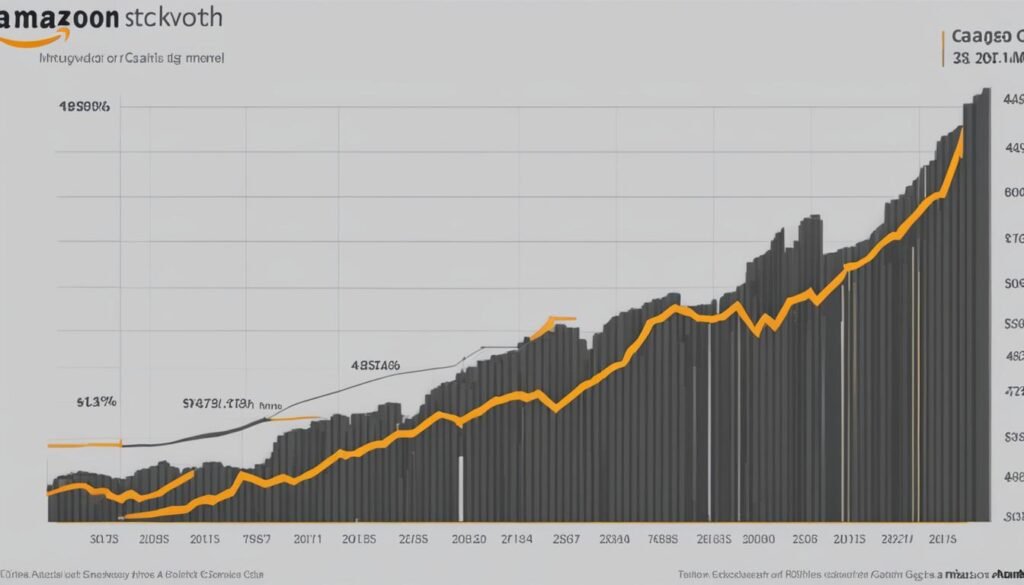

In response to latest knowledge, Amazon’s income has been persistently rising and is anticipated to proceed rising sooner or later. As of Q1 2021, Amazon’s income was round $108.5 billion, a 44% enhance YoY. The corporate’s inventory worth has additionally proven regular progress over the previous decade, with a median annual return of 38.7% from 2011-2020.

As well as, Amazon’s dedication to long-term investments and innovation has contributed to the corporate’s progress potential. For instance, Amazon’s acquisition of Entire Meals and funding in drone supply expertise showcase the corporate’s dedication to exploring new markets and enhancing buyer experiences.

Moreover, Amazon’s dominance within the e-commerce trade and the rising shift in direction of on-line procuring because of the pandemic make it a strong funding alternative.

General, investing in Amazon inventory generally is a profitable alternative for these seeking to develop their investments over the long run.

Researching Amazon: Key Metrics and Evaluation

Investing in Amazon inventory requires intensive analysis and evaluation. Understanding key metrics can help traders in making knowledgeable selections and reaching long-term progress. Listed here are some essential components to contemplate when researching Amazon:

Monetary Ratios

Amazon’s monetary ratios spotlight the corporate’s monetary well being and efficiency. Ratios reminiscent of price-to-earnings (P/E), price-to-sales (P/S), and return-on-equity (ROE) can present insights into the corporate’s valuation, income era, and profitability, respectively.

Income Progress

Amazon’s income progress is a vital metric to investigate because it displays the corporate’s capacity to extend its gross sales over time. Learning the pattern in income progress permits traders to judge the expansion potential of the corporate and examine it with its opponents.

Market Traits

Analyzing the market traits can help traders in understanding the demand for Amazon’s services and products. Preserving observe of the newest traits and aggressive panorama may also help traders anticipate future progress alternatives and make strategic funding selections.

“Learning the inventory market is like playing, however finding out Amazon is like counting playing cards.”

Investing in Amazon generally is a profitable alternative for traders who perceive the market and make use of sound funding methods. Researching key metrics and performing in-depth evaluation may also help traders make knowledgeable selections and obtain their long-term funding objectives.

Discovering a Dependable Brokerage: Selecting the Proper Platform

Selecting the best brokerage platform is essential to purchase Amazon inventory on-line. There are a number of components to contemplate when deciding on a brokerage, together with:

1. Charges

The charges for every brokerage platform can fluctuate broadly. Be certain to match the charges of various platforms to search out essentially the most inexpensive choice.

| Brokerage | Charge per Commerce | Minimal Deposit |

|---|---|---|

| E-Commerce | $6.95 | $0 |

| Constancy | $4.95 | $0 |

| TD Ameritrade | $6.95 | $0 |

2. Person Interface

The person interface of the brokerage platform is vital for navigating the web site simply. Select a platform that you simply discover straightforward to make use of and that has a transparent, intuitive interface.

3. Buyer Assist

In the case of investing your hard-earned cash, it is important to have entry to dependable buyer help. The brokerage platform you select ought to supply buyer help through telephone, e-mail, or chat.

4. Safety

Safety is a prime concern on the subject of investing in shares. Select a brokerage that gives sturdy security measures, reminiscent of two-factor authentication and encryption, to make sure the protection of your funding.

A few of the prime brokerage platforms to contemplate for purchasing Amazon inventory embody E-Commerce, Constancy, and TD Ameritrade. Do your analysis to search out the proper brokerage platform in your funding wants and objectives.

Opening an Account: Step-by-Step Course of

If you happen to’re able to spend money on Amazon inventory, step one is to open an account with a dependable brokerage platform. Comply with these steps for a clean account registration course of:

- Select a brokerage platform: Analysis and examine totally different brokerages to search out one which fits your funding wants and funds. Search for a platform that gives straightforward navigation, low charges, and glorious customer support. Some fashionable choices embody Constancy, Robinhood, and TD Ameritrade.

- Register your account: As soon as you have chosen a platform, register your account by offering your private particulars reminiscent of title, e-mail, and residential handle. Make sure to learn and conform to the platform’s phrases and situations.

- Confirm your id: Most brokerages would require some type of id verification to adjust to authorized and regulatory insurance policies. Comply with the directions supplied by the platform to confirm your id, sometimes by submitting a duplicate of your government-issued ID or driver’s license.

- Fund your account: After your account is verified, you may must fund it to start out investing. Most brokerages supply a number of deposit choices, together with financial institution transfers, credit score/debit playing cards, and digital fee companies. Select the choice that works greatest for you and switch the required funds to your account.

Opening an account with a brokerage platform is an easy course of that may be accomplished on-line from the consolation of your own home. Make sure to select a good and safe platform to safeguard your investments. Within the subsequent part, we’ll talk about how to decide on a dependable brokerage platform for purchasing Amazon inventory.

Funding Your Account: Deposit Choices

After getting chosen a dependable brokerage platform to buy Amazon shares, the following step is to fund your funding account. Most brokerage platforms present a spread of deposit choices, together with:

| Deposit Possibility | Processing Time | Charges |

|---|---|---|

| Financial institution transfers | Normally 1-3 enterprise days | Free, however your financial institution could cost a payment |

| Debit/bank card funds | Immediate | Normally 1-2% of transaction quantity |

| Digital fee companies (PayPal, Venmo, and so on.) | Immediate | Normally 1-2% of transaction quantity |

It is vital to notice that some fee strategies, reminiscent of bank cards, is probably not accepted by all brokerage platforms. Moreover, some platforms could require a minimal deposit quantity, so be sure you examine the phrases and situations earlier than deciding on a deposit choice.

After getting funded your account, you’re prepared to start out shopping for Amazon shares and constructing your funding portfolio.

Putting an Order: Shopping for Amazon Inventory

After finishing all of the analysis and evaluation, it is time to buy Amazon shares. To purchase Amazon inventory, traders can observe these easy steps:

- Log in to the brokerage account and navigate to the buying and selling platform.

- Choose the Amazon inventory image (AMZN).

- Select the order kind, reminiscent of market order, restrict order, or cease order.

- Enter the variety of shares to purchase and the worth restrict.

- Evaluation the order particulars and submit the order.

It is vital to notice that market orders execute on the present market worth, whereas restrict orders enable traders to set a most buy worth. A cease order triggers a purchase order if the inventory worth reaches a sure level. Relying on the brokerage platform, traders may additionally have entry to superior order varieties and options.

Earlier than finalizing the acquisition, double-check all particulars and make sure that there are adequate funds accessible to finish the transaction. As soon as the order is executed, the shares of Amazon inventory will likely be added to the investor’s portfolio.

Traders must also monitor their investments often and make changes as needed based mostly on their monetary objectives and market traits.

Managing Your Portfolio: Monitoring and Adjusting Investments

Investing in Amazon inventory requires a proactive strategy to portfolio administration. As with all funding, monitoring market traits and making changes when needed is essential for maximizing returns. Beneath are some recommendations on methods to successfully handle your Amazon inventory portfolio:

Set Funding Targets

Earlier than investing in Amazon inventory, it is vital to set clear funding objectives. This may make it easier to to remain targeted and make knowledgeable selections when making changes to your portfolio. Contemplate components reminiscent of your danger tolerance, funding timeline, and monetary goals as you identify your objectives.

Monitor Market Traits

Monitoring market traits is important for understanding the efficiency of Amazon inventory. Regulate related monetary information and trade updates to remain knowledgeable. Instruments reminiscent of inventory monitoring apps and on-line monetary assets also can make it easier to to remain up-to-date on market efficiency and trade information.

TIP: Make sure to take a look at the historic efficiency of Amazon inventory over time to get a greater sense of the way it performs in several market situations.

Rebalance Your Portfolio

Rebalancing your portfolio includes adjusting your investments to make sure that they align together with your funding objectives. This will likely contain shopping for or promoting Amazon inventory relying on market situations. It is vital to assessment your portfolio at common intervals and make changes as wanted to maintain it in keeping with your funding goals.

Search Knowledgeable Recommendation

Investing in Amazon inventory could be complicated, and it is vital to hunt skilled recommendation when making funding selections. Seek the advice of with a monetary advisor or funding skilled to get a greater understanding of the dangers and potential advantages of investing in Amazon inventory.

Investing in Amazon inventory generally is a rewarding expertise, but it surely requires cautious portfolio administration and a proactive strategy to maintain your investments aligned together with your objectives. By monitoring market traits and making changes when needed, you’ll be able to maximize your returns and obtain your funding goals.

Dividends and Capital Positive aspects: Understanding Returns

One of many the explanation why traders select to spend money on Amazon is the potential for top returns within the type of dividends and capital positive factors. Dividends are a distribution of a portion of the corporate’s earnings to its shareholders, whereas capital positive factors are the revenue earned from promoting shares for a better worth than the acquisition worth.

Amazon doesn’t at the moment pay dividends as the corporate reinvests its income into increasing its operations and exploring new alternatives. Nonetheless, the regular progress of the corporate’s inventory worth has led to important capital positive factors for traders over time. In reality, Amazon’s inventory has grown by a median of over 30% per yr for the previous decade.

When investing in Amazon inventory, it is very important take into account the potential for each dividends and capital positive factors. Whereas dividends could not at the moment be an choice, the potential for important capital positive factors makes Amazon a compelling funding alternative.

Dangers and Challenges: Assessing the Market

Investing in Amazon inventory shouldn’t be with out dangers and challenges. Market volatility, trade competitors, and regulatory modifications are a few of the components that traders ought to take into account earlier than investing in Amazon shares. You will need to undertake thorough analysis and evaluation earlier than making any funding selections.

One of many main dangers related to Amazon inventory is its susceptibility to market fluctuations. The inventory worth could rise or fall relying available on the market situations, making it troublesome to foretell future returns. Moreover, competitors within the retail trade could negatively impression Amazon’s market share and earnings. Regulatory modifications, reminiscent of tax or commerce insurance policies, may additionally have an effect on the corporate’s monetary efficiency.

Regardless of the inherent dangers, investing in Amazon generally is a profitable alternative for individuals who are keen to place within the effort to conduct correct analysis and evaluation. By understanding the dangers and challenges, traders could make knowledgeable selections to mitigate potential losses and maximize returns.

Comparability of Amazon and Rivals within the Retail Trade

| Firm | Market Capitalization ($B) | Worth-to-Earnings (P/E) Ratio | Income Progress (Yr-over-Yr) |

|---|---|---|---|

| Amazon | 1,752.95 | 87.70 | 27.90% |

| Walmart | 385.77 | 13.43 | 5.20% |

| Goal | 129.22 | 18.14 | 20.60% |

Be aware: Knowledge as of September 2021

The desk above compares Amazon’s market capitalization, price-to-earnings ratio, and income progress to 2 of its main opponents within the retail trade, Walmart and Goal. The comparability exhibits Amazon’s dominance by way of market capitalization and income progress, indicating its sturdy place out there. Nonetheless, its price-to-earnings ratio is significantly greater than each Walmart and Goal, suggesting that the inventory could also be overvalued in comparison with its opponents. Traders ought to take into account this knowledge when assessing the dangers and potential rewards of investing in Amazon inventory.

Tax Implications: Understanding the Influence

As with all funding, understanding the tax implications of investing in Amazon inventory is important for maximizing returns and avoiding penalties. If you spend money on Amazon, it’s possible you’ll be topic to capital positive factors tax, which is levied on the income earned from promoting your shares. Dividends obtained from Amazon may even be topic to tax, however the fee could fluctuate relying on quite a lot of components.

As well as, when shopping for and promoting Amazon inventory, you may want to contemplate tax reporting necessities. For instance, if you happen to promote your Amazon shares, you may must report the transaction in your tax return and pay any capital positive factors tax owed. Thankfully, many brokerage platforms present tax reporting instruments and assets that can assist you keep organized and on prime of your tax obligations.

| Tax Sort | Price |

|---|---|

| Capital Positive aspects Tax | Varies based mostly on revenue bracket and holding interval |

| Dividend Tax | Varies based mostly on kind of dividend and complete revenue |

It is really helpful that you simply seek the advice of with a tax skilled to totally perceive the impression of investing in Amazon inventory in your total tax state of affairs. By taking the time to analysis and plan for tax implications, you may make knowledgeable selections and in the end maximize your returns when investing in Amazon.

Knowledgeable Methods: Suggestions from Seasoned Traders

In the case of investing in Amazon inventory, it helps to be taught from those that have expertise out there. Listed here are some skilled methods and ideas from seasoned traders on methods to maximize returns when buying Amazon shares:

“Put money into Amazon for the long-term.”

Amazon’s progress potential has been persistently excessive over time, but it surely’s important to maintain a long-term view when investing within the firm. Quick-term fluctuations are frequent within the inventory market, however profitable traders perceive that persistence and dedication are essential when searching for substantial returns.

– Jeffrey Bezos, Founding father of Amazon

| TIP | DESCRIPTION |

|---|---|

| 1 | Diversify your portfolio. Investing in Amazon is a superb alternative, but it surely should not be your solely funding. Diversify your portfolio by including shares from totally different industries to scale back danger. |

| 2 | Keep knowledgeable about Amazon’s competitors. Amazon is a dominant participant within the e-commerce trade, but it surely’s essential to remain up to date about its opponents and their market methods. This info may also help you make knowledgeable funding selections. |

| 3 | Monitor market traits. The inventory market is dynamic, and traits can change rapidly. Monitoring market traits and reacting to them promptly is an efficient solution to obtain higher funding returns. |

| 4 | Set funding objectives. Defining funding objectives may also help you keep targeted and motivated as you navigate the inventory market. Whether or not it is a sure share of returns or a specific timeline for funding, having clear objectives can preserve you on observe. |

Making use of these methods and ideas may also help traders keep away from frequent pitfalls and maximize their funding returns when shopping for Amazon inventory.

Staying Knowledgeable: The Function of Analysis and Evaluation

Investing in Amazon inventory can yield excessive returns, but it surely’s essential to remain knowledgeable on market traits and insights to benefit from your funding. Conducting steady analysis and evaluation is vital, as market situations and firm efficiency can shift quickly.

There are a number of assets and platforms that traders can use to remain up-to-date on the newest information and knowledge associated to Amazon inventory, together with:

- Monetary information retailers reminiscent of Bloomberg, CNBC, and Forbes

- Investor relations pages on Amazon’s web site

- On-line buying and selling boards and communities

It is also vital to conduct your personal evaluation and assessments of the market and Amazon’s efficiency, utilizing instruments reminiscent of monetary ratios, price-to-earnings (P/E) ratios, and dividend yields to make knowledgeable funding selections.

As talked about beforehand, it is vital to handle your portfolio by way of steady monitoring and changes as wanted, significantly as market situations evolve. Maintaining a tally of the information and analyzing traits may also help you make knowledgeable selections about when to purchase, maintain, or promote Amazon inventory.

Investing in Amazon generally is a worthwhile long-term funding, however provided that you strategy it with cautious consideration and knowledgeable decision-making. Keep knowledgeable and conduct thorough evaluation to maximise your returns.

Conclusion

Investing in Amazon inventory generally is a sensible transfer for long-term traders seeking to diversify their portfolio and faucet into the expansion potential of the e-commerce big. By following the ideas and techniques outlined on this information, potential traders could make knowledgeable selections when shopping for Amazon inventory, from researching key metrics to selecting a dependable brokerage platform and managing their portfolio successfully.

Keep in mind, investing within the inventory market includes dangers and challenges, and it is vital to evaluate these components earlier than making any funding selections. Nonetheless, with its market dominance, progressive services and products, and powerful monetary efficiency, Amazon stays a prime decide for a lot of traders.

So, whether or not you are seeking to purchase Amazon inventory for the primary time or so as to add to your present portfolio, be certain that to do your analysis, keep knowledgeable, and seek the advice of with a monetary advisor if wanted. With persistence, self-discipline, and a long-term perspective, investing in Amazon inventory generally is a rewarding expertise.

Do not miss out on the chance to spend money on Amazon – begin exploring your choices immediately and buy Amazon shares!

FAQ

How can I purchase Amazon inventory?

To purchase Amazon inventory, you could open an funding account with a brokerage platform that gives Amazon shares. As soon as your account is ready up, you’ll be able to place an order to buy Amazon inventory by way of the platform. Be certain to analysis the brokerage platform and perceive the method earlier than continuing with any transactions.

Why ought to I spend money on Amazon inventory?

Investing in Amazon inventory can supply important potential returns because of the firm’s sturdy progress prospects and market efficiency. Amazon has persistently proven innovation and dominance in varied sectors, together with e-commerce, cloud computing, and digital streaming. Consequently, many traders see Amazon as a long-term funding alternative with the potential for substantial capital positive factors.

What key metrics and evaluation ought to I take into account when researching Amazon inventory?

When researching Amazon inventory, it’s important to contemplate components reminiscent of the corporate’s income progress, revenue margins, market share, and aggressive panorama. Monetary ratios, reminiscent of price-to-earnings ratio (P/E), price-to-sales ratio (P/S), and return on fairness (ROE), also can present beneficial insights. Moreover, analyzing trade traits and market situations can additional assist assess the potential worth of Amazon inventory.

How do I select a dependable brokerage platform to purchase Amazon inventory?

When deciding on a brokerage platform to purchase Amazon inventory, take into account components reminiscent of charges and commissions, person interface and ease of use, buyer help availability, and safety measures. Evaluate totally different platforms and browse opinions to discover a respected brokerage that aligns together with your funding objectives and preferences.

What’s the step-by-step course of to open an account for purchasing Amazon shares?

The step-by-step course of to open an account for shopping for Amazon shares could fluctuate relying on the brokerage platform you select. Usually, it includes creating an account on the platform’s web site or app, offering needed private info, finishing id verification, and agreeing to the phrases and situations. Some platforms may additionally require further documentation and proof of residence.

What are the funding choices that can be purchased Amazon inventory?

To fund your account for purchasing Amazon inventory, brokerage platforms typically supply choices reminiscent of financial institution transfers, debit/bank card funds, and digital fee companies like PayPal. Every platform could have particular necessities, processing occasions, and limits for every funding technique, so it is important to familiarize your self with these choices earlier than making a deposit.

How do I place an order to purchase Amazon inventory?

Putting an order to purchase Amazon inventory includes specifying the variety of shares you need to buy and deciding on the suitable order kind, reminiscent of market order, restrict order, or cease order. Additionally, you will must set the worth at which you’re keen to purchase the inventory. These choices are sometimes accessible on the brokerage platform’s order placement interface.

How can I successfully handle my Amazon inventory portfolio?

To successfully handle your Amazon inventory portfolio, it is essential to often monitor market traits, firm information, and monetary efficiency. Set clear funding objectives and assessment your portfolio’s efficiency periodically. If needed, make changes to your holdings based mostly in your danger tolerance and market situations, guaranteeing a diversified funding strategy.

What are dividends and capital positive factors in relation to investing in Amazon inventory?

Dividends are funds made by firms to their shareholders as a distribution of income, whereas capital positive factors discuss with the rise within the worth of an funding over time. Within the case of Amazon, the corporate doesn’t at the moment pay dividends, and traders can primarily anticipate capital positive factors by way of the appreciation of the inventory’s worth.

What are the dangers and challenges related to investing in Amazon inventory?

Investing in Amazon inventory includes sure dangers and challenges, together with market volatility, trade competitors, and regulatory modifications. The inventory worth can fluctuate considerably, and previous efficiency shouldn’t be a assure of future outcomes. Moreover, traders ought to keep knowledgeable about Amazon’s potential dangers, reminiscent of dependence on sure markets or disruptive applied sciences, earlier than making any funding selections.

What are the tax implications of investing in Amazon inventory?

Investing in Amazon inventory could have tax implications, reminiscent of capital positive factors tax on the sale of shares and the potential tax remedy of any dividends obtained if the corporate begins paying dividends sooner or later. It is vital to seek the advice of with a tax skilled or accountant to know the particular tax guidelines and reporting obligations in your jurisdiction.

What skilled methods and ideas may also help maximize funding returns when shopping for Amazon inventory?

Knowledgeable methods to maximise funding returns when shopping for Amazon inventory could embody diversifying your portfolio, staying knowledgeable by way of ongoing analysis, and setting real looking long-term objectives. Contemplate consulting with a monetary advisor to develop an funding technique that aligns together with your danger tolerance and monetary goals.

How can I keep knowledgeable about Amazon inventory and market insights?

To remain knowledgeable about Amazon inventory and market insights, make the most of assets reminiscent of monetary information web sites, funding analysis platforms, and official firm bulletins. Some brokerage platforms additionally present entry to analysis experiences and evaluation. Recurrently assessment and analyze related info to make knowledgeable funding selections.

What are the important thing takeaways when contemplating shopping for Amazon inventory?

Key takeaways when contemplating shopping for Amazon inventory embody understanding the method of shopping for shares by way of a brokerage platform, conducting thorough analysis on Amazon’s monetary efficiency and market situations, and punctiliously managing your funding portfolio. It is vital to evaluate the potential dangers and rewards related to investing in Amazon and seek the advice of with monetary professionals if wanted.

New York Stock Exchange

New York Stock Exchange Australian Stock Exchange

Australian Stock Exchange Toronto Stock Exchange

Toronto Stock Exchange Johannesburg Stock Exchange

Johannesburg Stock Exchange Bombay Stock Exchange

Bombay Stock Exchange New Zealand Stock Exchange

New Zealand Stock Exchange Nigerian Stock Exchange

Nigerian Stock Exchange Kenya Stock Exchange

Kenya Stock Exchange