APPLE (AAPL) Stocks: How to Buy Apple Stock – Investment Guide

ABOUT APPLE 💰💲

Multinational expertise firm Apple Inc. develops, designs and sells laptop software program, on-line providers and shopper electronics. Together with Google, Fb and Amazon it’s thought of one of many Huge 4.

Apple is renowned for its range of hardware products, including the iPad tablet, iPhone smartphone, iPod portable media player, Apple Watch smartwatch, Mac personal computer, HomePod smart speaker, Apple TV digital media player, and Apple AirPods wireless earbuds.

The corporate’s software program contains the iTunes media participant, the macOS and iOS working techniques, the iLife and iWork productiveness and creativity suites and the Safari internet browser.

Apple’s skilled purposes embrace Logic Professional, Xcode and Remaining Minimize Professional.

The corporate’s on-line providers embrace the Mac App Retailer, the iTunes Retailer, Apple Music, iCloud, the iOS App Retailer, iMessage and Apple TV+. Its different providers embrace Genius Bar, AppleCare, Apple Card, Apple Retailer, Apple Pay and Apple Pay Money.

Merchandise are bought worldwide by means of Apple’s on-line shops, direct gross sales pressure, third-party wholesalers, its retail shops and resellers. Apple Inc.’s historical past goes again to 1976 when it was based. Its headquarters has remained in Cupertino, California for the reason that begin of the corporate.

At this time Apple has roughly 132 000 workers.

A few of Apple’s subsidiaries are Apple Retailer, Beats Electronics, FileMaker, Beddit, FingerWorks, PrimeSense and Anobit.

You may also like: AMGEN STOCKS

RECOMMENDED NASDAQ BROKER

OVERVIEW OF APPLE

- Steve Jobs, Steve Wozniak and Ronald Wayne based Apple in 1976. The corporate is based to develop and promote Apple I, Wozniak’s private laptop. Inside 12 days Wayne sells his share again. In 1977 it’s integrated as Apple Pc, Inc. and laptop gross sales, which incorporates the Apple II grows quick.

- In 1980 the corporate goes public with rapid monetary success after laptop designers are employed and a manufacturing line is put in place. The corporate begins producing new computer systems over the following few years with progressive graphical person interfaces, such because the 1984 authentic Macintosh.

- Within the 1990’s Apple loses market share to lower-priced Microsoft Home windows on Intel PC clones.

- In 1997 Apple buys NeXT fixing its desperately failed working system technique. The corporate begins returning revenue and launches the iMac in 1998.

- In 2001 the retail chain of Apple Shops are opened and quite a few firms are purchased to broaden Apple’s software program portfolio. In 2007 the corporate is renamed Apple Inc. and the iPhone is launched.

- As of 2018 Apple Inc. has 504 retail shops in 24 international locations. It additionally operates the world’s largest music retailer, the iTunes Retailer. Greater than 1.3 billion Apple merchandise are actively used throughout the globe as of January 2018.

- Apple Inc. is ranked the world’s most beneficial model. The corporate does nevertheless obtain vital criticism relating to its environmental practices, unethical enterprise practices, origins of supply supplies and labor practices of its contractors.

VALUES OF APPLE

- Apple Inc. values accessibility because it believes that expertise is strongest when it empowers everybody.

- Since 2014 Apple Inc. has been a part of the ConnectED initiative – pledging US Greenback 100 million of educating and studying options to greater than a 100 underserved faculties within the U.S.

- In 2019 Apple goals to attenuate its affect on the atmosphere and such an instance is the brand new MacBook Air and Mac mini which has enclosures made from 100% recycled aluminium.

MARKET PERFORMANCE OF APPLE

- Apple Inc. trades on the New York Stock Exchange beneath the NYSE Inventory Image “AAPL”.

- In 2018 the corporate’s worldwide annual income totalled US Greenback 265 billion for the fiscal 12 months. By income it’s the world’s largest data expertise firm.

- It’s also the world’s third largest cell phone producer after Samsung and Huawei. Apple Inc. grew to become the primary public U.S. firm to be valued at over US Greenback 1 trillion in August 2018.

You may also like: AMERICAN EXPRESS STOCKS

LATEST NEWS ON APPLE

A Step by Step Information the right way to Purchase / Buy APPLE Shares on-line.

Earlier than shopping for any inventory or share one has to contemplate a couple of elements.

STEP 1: PROPER RESEARCH IS ESSENTIAL

Upon deciding you wish to purchase APPLE Shares / Shares, it’s vital for the intense investor to do correct analysis into the mentioned firm. Its values ought to align with these of the investor’s present portfolio. An investor must familiarise himself with the fundamentals and historical past of the corporate, in addition to its management and efficiency out there. Its firm reviews also needs to be scrutinized.

Session with a brokerage agency also can help in figuring out whether or not investing in a selected firm will complement the investor’s present portfolio. The funding “danger ladder”, which identifies asset courses based mostly on their relative riskiness, is one other useful gizmo when figuring out which firm’s inventory / share is the very best to purchase.

STEP 2: CALCULATE THE AMOUNT OF INVESTMENT IN APPLE STOCKS / SHARES

It will be significant for an investor to observe his whole funding in inventory so as to preserve his portfolio aligned to his funding technique. The general worth of his holdings will change with the fluctuation in inventory costs, which might throw his portfolio off stability. To find out the quantity to take a position, multiply the variety of shares of every inventory by its present market value to find out the overall funding in that particular inventory. For instance, for those who personal 100 shares of a US Greenback 5 inventory, multiply 100 by US Greenback 5 to get US Greenback 500.

STEP 3: DECIDE ON THE STOCK / SHARE ORDER TYPE

Traders can select from a market order, a restrict order, a cease order (additionally known as a stop-loss order) or a purchase/promote cease order. You will need to familiarise your self with every kind’s professionals and cons earlier than deciding which one will fit your present inventory profile greatest. An investor ought to be guided on this selection by his funding goal.

STEP 4: OPEN A BROKERAGE ACCOUNT

A brokerage account – often known as taxable funding account – is much like a retirement account, however extra versatile. The place a retirement account has limitations on the sum of money that may be contributed yearly, and restrictions on when funds will be withdrawn, a brokerage account is extra versatile. The latter has no revenue or contribution restrict and the investor can withdraw his cash at any given time. This flexibility, along with its potential funding good points, makes a brokerage account extra engaging to severe traders. Brokerage accounts are perfect for targets or financial savings which are additional than 5 years away, however nearer than retirement. It could additionally complement an investor’s emergency financial savings.

STEP 5: COMMIT AND PURCHASE APPLE STOCKS / SHARES

5 Inquiries to ask your self earlier than buying any shares or shares.

- Is it the very best time to purchase this inventory / share?

- Ought to I purchase APPLE shares / shares within the present financial local weather?

- Can I afford to purchase this inventory / share?

- What’s the forecast of the inventory / share development?

- What’s the present value per incomes ration on the inventory / share?

Welcome to our comprehensive guide on how to buy Apple stock. Investing in Apple can be a lucrative opportunity, and it’s essential to understand the process of buying Apple shares to start building your investment portfolio. In this guide, we’ll take you through everything you need to know, from researching the company to placing your first stock order.

Apple is a leading tech giant with a diverse range of products and services. From iPhones to MacBooks to Apple Music, Apple has a significant global presence and a loyal customer base. Buying Apple stock allows you to own a part of this diversified and highly profitable company.

Key Takeaways

- Investing in Apple stock can be a lucrative opportunity.

- Buying Apple stock allows you to own part of a leading tech giant with a diverse range of products and services.

- Researching the company, understanding the stock market, and setting up a brokerage account are essential steps in buying Apple stock.

- Monitoring your investment and seeking professional advice can help you manage investment risks and adjust your investment strategy.

- Tax implications and understanding your investment goals are crucial for long-term investment success.

Why Invest in Apple Stock?

If you’re considering investing in the stock market, Apple is a company worth considering. With a market cap of over $2 trillion, Apple is one of the world’s leading technology companies, making it an attractive opportunity for investors.

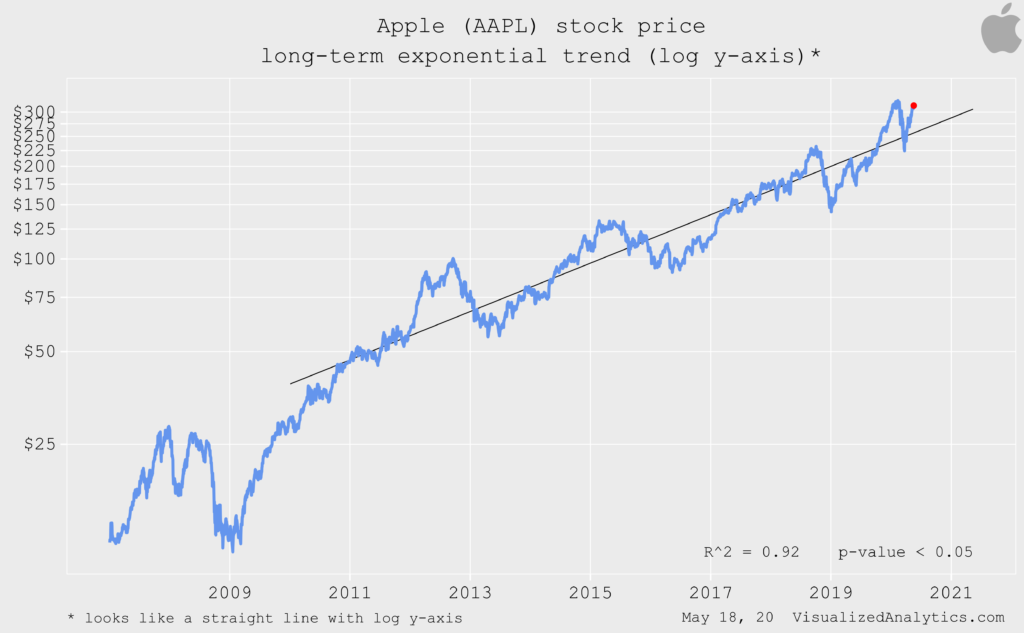

Apple Stock Price

The current Apple stock price reflects the company’s successful track record of product development and innovation. Despite occasional dips, Apple’s stock has grown significantly over the years, demonstrating the potential for long-term investment gains.

Apple Stock Market

Apple’s success in the stock market is reflected in stock market indices such as the NASDAQ and the S&P 500. As of August 2021, Apple accounts for over 6% of the S&P 500 index, making it one of the most influential companies in the overall stock market.

Potential for Future Growth

Looking forward, Apple’s expanding product line and focus on services such as Apple Music and the App Store offer significant potential for growth. Additionally, with the increasing demand for technology and the continued digitization of industries worldwide, Apple is positioned to maintain its market leadership for years to come.

By investing in Apple stock, you have the potential to benefit from the company’s continued success and growth in the global technology market.

Researching Apple as an Investment

Investing in Apple stock can provide lucrative returns if you conduct thorough research before making investment decisions. Here are some crucial factors to consider while researching Apple as an investment:

Apple Financials

Examining Apple’s financial performance is a crucial aspect of researching Apple as an investment. Apple’s revenue, earnings, cash flow, and debt should be analyzed to gain an understanding of the company’s financial health. The investor relations section of Apple’s website provides detailed financial statements, which can be useful to analyze Apple’s financials.

Apple Products

Apple’s product lineup is diverse and constantly evolving. Conducting research on Apple’s current products, upcoming product launches, and product innovation is essential to make informed investment decisions. Apple’s website and investor relations releases can be useful sources to track Apple’s product portfolio.

Apple Market Share

Apple’s market share in the tech industry should also be considered while researching Apple as an investment. Analyzing the market share of Apple’s products globally and regionally can provide insights into the company’s competitive position in the market. The investor relations section of Apple’s website provides market share information that can be useful to investors.

“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffet

Keeping in mind these essential aspects while researching Apple as an investment can help make informed investment decisions. Conduct thorough research and keep track of market trends before investing in Apple stock.

Understanding the Stock Market

Investing in the stock market can be rewarding, but it’s crucial to have a basic understanding of its key concepts, terms, and trading strategies. Here’s what you need to know before buying Apple stock.

Stock Market Basics

Stock markets are where buyers and sellers trade shares of publicly-traded companies. The prices of these shares fluctuate based on supply and demand, and investors can buy or sell shares at any time the market is open.

Stock Market Terms

Some key terms to know when investing in the stock market:

- Stocks: Ownership shares of a company

- Dividends: A share of the company’s profits paid out to shareholders

- Indices: A metric used to evaluate a group of stocks

- Bonds: Fixed-income securities issued by corporations or governments

- Exchange-Traded Funds (ETFs): Diversified investment funds that trade on exchanges like stocks

Stock Market Trading

When buying or selling stocks, investors have two main options:

- Market Order: A request to buy or sell a stock at the current market price

- Limit Order: A request to buy or sell a stock at a specific price or better

To make sound investment decisions, it’s important to stay informed about market trends, stock news, and financial updates. Consider using investment tracking tools and resources to help keep track of your portfolio and stay up-to-date on market movements.

“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett

Setting Up a Brokerage Account

To invest in Apple stock, you need a brokerage account. This requires an online brokerage to work with. Online brokerages are popular as they are convenient and offer a wide range of investment options. Follow these steps to set up your account:

- Research different online brokerages to find the one that fits your investment needs and budget.

- Select ‘Open an Account’ on their website’s homepage, which will take you to a form.

- Complete the form by providing your name, contact information, Social Security number, and employment information.

- Choose the type of account you want to open, such as an individual account or a retirement account.

- Fund your account, which can typically be done through an electronic transfer, wire transfer, or check.

It’s paramount to choose a reputable and reliable brokerage firm. Select a brokerage that meets your investment goals and offers the tools and support needed for successful trading.

Remember that setting up a brokerage account requires many variables, documents and sometimes fees. Thus, when selecting an online brokerage, it is essential to read their terms and conditions thoroughly and clarify any uncertainties by contacting their customer support team.

Funding Your Account

Once you have set up a brokerage account, the next step is to fund it to start investing in Apple stock. There are several methods available for depositing funds into your account, and it’s important to choose the most convenient and secure option for you.

Payment Methods for Funding Your Brokerage Account

Here are some commonly used payment methods for funding your brokerage account:

| Payment Method | Details |

|---|---|

| Bank Transfer | You can transfer funds from your bank account to your brokerage account. This method typically takes 2-3 business days to process. |

| Credit or Debit Card | You can use your credit or debit card to deposit funds into your brokerage account. This method is usually processed instantly, but some brokers may charge a fee. |

| Electronic Payment Services | You can use electronic payment services like PayPal or Skrill to deposit funds into your brokerage account. This method is fast and secure, but some brokers may not accept these payment methods. |

Before selecting a payment method, it’s important to check with your broker for any transaction fees or processing times associated with each method.

Remember to keep a record of your transactions for tax purposes and to monitor your account’s balance regularly. With a fully funded brokerage account, you’re ready to place your first order to buy Apple stock.

Placing an Order

Placing an order to buy Apple shares requires you to have a brokerage account and funds deposited. Once you’re ready to place an order, you have two options: market order or limit order.

A market order is executed at the current market price. If you want to buy Apple shares immediately, regardless of the price, a market order may be suitable for you. However, keep in mind that the execution price may differ from the price you initially saw due to market fluctuations.

A limit order allows you to set a maximum purchase price for Apple shares. If the stock price dips below your set limit, the order will be executed automatically. This type of order offers more control over the execution price, which can be beneficial in volatile market conditions.

Tip: To maximize your chances of executing a successful trade, it’s essential to monitor the market closely and adjust your orders accordingly.

Monitoring Your Investment

After investing in Apple stock, keeping track of its performance is crucial to making informed decisions. One way to monitor stock performance is by tracking the Apple stock price regularly. This can be done by checking financial news websites, such as Bloomberg and Yahoo Finance.

Another way to stay up-to-date on your investment is by using investment tracking tools. Various online platforms, such as Google Finance and Robinhood, offer customizable dashboards that allow you to track your Apple stock and other investments in one place.

By setting up alerts and notifications, you can track changes in the Apple stock market and receive updates on your portfolio. These investment tracking tools can help you make data-driven decisions based on real-time information.

Apple Dividends and Stock Splits

If you’re considering investing in Apple, it’s important to understand the company’s dividend policies and stock split history.

Apple started paying dividends in August 2012 after a 17-year hiatus, and since then, its dividends have grown consistently.

In 2021, Apple’s annual dividend payout was $0.88 per share, up from $0.76 per share in 2020. The company’s dividend yield is currently around 0.6%.

Apple has also undergone multiple stock splits throughout its history. In 1987, Apple undertook a two-for-one stock split, meaning shareholders received two shares for every one share they owned.

Since then, Apple has undergone three additional stock splits:

| Split Date | Split Ratio |

|---|---|

| June 1987 | 2-for-1 |

| June 2000 | 2-for-1 |

| February 2005 | 2-for-1 |

| August 2020 | 4-for-1 |

Stock splits can make shares more affordable for investors and increase liquidity in the market. It’s important to note that while stock splits do not directly increase the value of an investment, they can make it more accessible to a wider range of investors.

If you’re looking to reinvest your dividends, Apple also offers a dividend reinvestment plan (DRIP). This plan allows you to use your dividends to automatically purchase more shares of Apple stock, providing the potential for compounded returns over time.

Managing Risks and Diversifying Your Portfolio

Investing in Apple stock can be lucrative, but it’s important to remember that every investment involves risks. To mitigate these risks, it’s essential to diversify your portfolio by investing in a range of assets. This can help protect your investment from fluctuations in the stock market and reduce overall risk.

When it comes to managing risks specific to investing in Apple stock, it’s important to consider factors such as competition, product development, and market trends. Apple operates in a highly competitive industry and faces constant pressure to innovate and develop new products to stay ahead of the competition. Additionally, market trends can affect the demand for Apple products, which can impact stock prices.

“Diversification is a key component of successful portfolio management.”

One way to manage the risks associated with investing in Apple stock is to diversify your portfolio with assets such as bonds, mutual funds, and exchange-traded funds. These investments can help balance your portfolio and reduce risk by spreading your investment across different asset classes.

Apple Stock Performance Compared to the S&P 500

| Apple | S&P 500 | |

|---|---|---|

| 2019 | +86.16% | +28.88% |

| 2020 | +81.37% | +16.26% |

| 2021 | +11.19% | +18.69% |

While Apple has historically outperformed the S&P 500, it’s important to remember that past performance doesn’t guarantee future results. Diversifying your portfolio can help reduce risk and protect your investment in case of market downturns or changes in industry trends.

Seeking Professional Advice

If you’re new to investing or simply need guidance, seeking professional financial advice can be a wise decision. Financial advisors provide tailored recommendations based on your unique financial situation and goals. An investment advisor can offer professional guidance on the different investment options available and help you develop an investment plan that aligns with your financial objectives.

When selecting an investment advisor, it’s essential to consider their qualifications, experience, and track record. Look for an advisor who holds relevant certifications and has a history of successful client relationships. You can also ask for referrals from trusted sources or read online reviews to find a reputable advisor.

Meeting with a financial advisor can help you determine your risk tolerance and create a diversified investment plan that works best for you. With professional guidance, you’ll be better equipped to make informed decisions and manage the risks associated with investing in Apple stock.

Tax Implications of Investing in Apple Stock

When investing in Apple stock, it’s essential to understand the tax implications. Investors should be aware of investment taxes, which are taxes that a government levies on income and capital gains earned from investments. Capital gains taxes are paid after selling an investment asset such as securities at a profit.

If you hold Apple stock for more than a year and then sell it, you might be eligible for a long-term capital gains tax. Long-term capital gains taxes are usually lower than short-term capital gains taxes. To qualify for long-term capital gains treatment, you must hold the stock for more than a year.

In contrast, short-term capital gains tax is applied to profits earned on investments owned for less than a year. These taxes are generally higher than long-term capital gains taxes and are taxed at the investor’s ordinary income tax rate.

Investors should be aware of tax considerations when investing in Apple stock and carefully track all trades to comply with tax requirements. It’s a good idea to consult with a tax advisor or financial planner regarding investment taxes before investing in the stock market.

| Tax Rate | Single Filers | Married Filing Jointly | Head of Household |

|---|---|---|---|

| 0% | Up to $40,400 | Up to $80,800 | Up to $54,100 |

| 15% | $40,401 – $445,850 | $80,801 – $501,600 | $54,101 – $473,750 |

| 20% | Over $445,850 | Over $501,600 | Over $473,750 |

Table: Capital gains tax rates apply to the sale of investment assets such as stocks, ETFs, and mutual funds. Rates vary depending on income level and filing status. The rates apply only when investments have been held for more than one year (long-term capital gain).

Tax Considerations When Investing in Apple Stock

Before investing in Apple stock, it’s important to be familiar with the tax considerations. Here are some tax factors that may impact investors:

- Dividend Tax: If you receive dividends from Apple, you’ll have to pay taxes on those earnings.

- Tax Loss Harvesting: If Apple stock loses value, investors can use tax loss harvesting to offset losses against gains.

- Retirement Accounts: Investors can hold shares of Apple stock in a tax-advantaged retirement account such as an Individual Retirement Account (IRA) or a 401(k).

- State Taxes: Investors should check their state tax rates as they can vary depending on the state of residence.

By understanding tax considerations when investing in Apple stock, investors can make informed decisions that result in higher returns and lower tax bills.

Reviewing and Adjusting Your Investment Strategy

Investing in Apple stock is a long-term commitment that requires regular monitoring and evaluation. Making timely adjustments to your investment strategy can help maximize profits and minimize risks, ensuring long-term success.

One effective method for reviewing your strategy is to regularly analyze your portfolio performance. This involves determining how well your Apple stock investment is performing compared to the overall market and your long-term goals.

Another important aspect of your investment strategy is diversification. Diversifying your portfolio by investing in different asset classes can help mitigate risks and ensure a balanced investment approach.

When considering adjustments to your strategy, it’s essential to consider market conditions and any changes to Apple’s financial performance or market share carefully. This research should inform any changes to your investment strategy.

In summary, conducting regular reviews of your investment strategy and making necessary adjustments is vital to ensuring long-term success when investing in Apple stock. Monitoring performance, diversifying your portfolio, and considering market conditions are all essential steps in this process.

Conclusion

Investing in Apple stock can be a wise financial decision and potential step towards building a healthy investment portfolio. This guide has provided a comprehensive roadmap for buying Apple stock, from researching the market and setting up a brokerage account, to monitoring your investment and managing risks.

Remember, investing involves risks, and it’s important to stay informed and make educated decisions. Seek professional advice if needed, regularly review and adjust your investment strategy, and stay up-to-date with tax implications and market trends.

By following these guidelines, you can confidently invest in Apple stock and potentially reap the benefits of investing in one of the world’s most innovative and profitable tech companies. Start your investment journey today and enjoy the long-term rewards that come with a well-managed portfolio.

FAQ

How can I buy Apple stock?

To buy Apple stock, you need to open a brokerage account with an online brokerage platform. Once your account is set up, you can place an order to purchase Apple shares through the platform.

Why should I consider investing in Apple stock?

Investing in Apple stock can be a lucrative opportunity due to various factors. Apple is a leading tech giant with a strong market presence and a history of innovation. The current Apple stock price and market trends indicate potential for future growth, making it an attractive investment option.

What factors should I research before investing in Apple stock?

Before investing in Apple stock, it’s important to research factors such as Apple’s financial performance, product lineup, and market share. By understanding these aspects, you can make an informed investment decision.

What should I know about the stock market before buying Apple stock?

Before buying Apple stock, it’s essential to have a basic understanding of the stock market. Familiarize yourself with key concepts, terms, and trading strategies to navigate the market effectively.

How do I set up a brokerage account?

Setting up a brokerage account is necessary to buy Apple stock. You can open an account with an online brokerage by providing your personal information, completing the required paperwork, and fulfilling any funding requirements.

What are the different methods of funding a brokerage account?

You can fund your brokerage account through various methods, including bank transfers, wire transfers, credit or debit card payments, and electronic wallet transfers. Choose the option that suits your convenience and ensures secure transaction processing.

How do I place an order to buy Apple stock?

Placing an order to buy Apple stock involves selecting the desired quantity of shares and specifying the order type, such as a limit order or a market order. Follow the instructions provided by your brokerage platform to complete the purchase.

How can I monitor the performance of my Apple stock investment?

To monitor the performance of your Apple stock investment, you can track Apple’s stock price through various sources, including financial news websites, brokerage platforms, and investment tracking tools. These resources provide real-time updates on stock price fluctuations.

Does Apple pay dividends or have stock splits?

Yes, Apple pays dividends to shareholders and has a history of stock splits. Dividends are payments made by the company to shareholders as a portion of its earnings. Stock splits, on the other hand, involve dividing existing shares into multiple shares to adjust the stock price. Both dividends and stock splits can impact your investment in Apple stock.

How can I manage risks associated with investing in Apple stock?

Every investment carries risks, including investing in Apple stock. To manage these risks, consider diversifying your investment portfolio by including other stocks or asset classes. This can help mitigate the impact of market fluctuations specific to Apple.

Should I seek professional advice for my Apple stock investment?

Seeking professional advice, such as from a financial advisor, can be beneficial if you’re uncertain about making investment decisions on your own. A qualified advisor can provide guidance based on your financial goals and risk tolerance, helping you make informed choices regarding your Apple stock investment.

What are the tax implications of investing in Apple stock?

Investing in Apple stock has tax implications. When you sell your Apple shares, you may be subject to capital gains tax. It’s crucial to understand the applicable tax laws and regulations and consider consulting with a tax professional to navigate the tax landscape related to your investment.

How often should I review and adjust my Apple stock investment strategy?

Regularly reviewing and adjusting your investment strategy is important for long-term success. Market conditions and your financial goals may change over time, so it’s advisable to evaluate your Apple stock investment periodically and make necessary adjustments to ensure it aligns with your objectives.

New York Stock Exchange

New York Stock Exchange Australian Stock Exchange

Australian Stock Exchange Toronto Stock Exchange

Toronto Stock Exchange Johannesburg Stock Exchange

Johannesburg Stock Exchange Bombay Stock Exchange

Bombay Stock Exchange New Zealand Stock Exchange

New Zealand Stock Exchange Nigerian Stock Exchange

Nigerian Stock Exchange Kenya Stock Exchange

Kenya Stock Exchange