AMAZON (AMZN) Stocks: A Step by Step to Purchase / Buy AMAZON Shares on-line

ABOUT AMAZON

Amazon.com Inc. is a multinational firm that gives digital streaming, synthetic intelligence, cloud computing and e-commerce to lots of of tens of millions of shoppers throughout the globe.

The corporate has over 560,000 staff, 2 million sellers, lots of of hundreds of authors and builders. Amazon is among the largest web firms on this planet and one of many largest employers in america. The corporate’s head workplace is in Seattle, Washington.

You may additionally like: APPLE STOCKSRECOMMENDED NASDAQ BROKER

67% of retail investor accounts lose cash when buying and selling CFD’s

📦 Amazon: The E-Commerce Giant

🌟 A Remarkable Journey

Founded in 1994 in the state of Washington, Amazon, under the visionary leadership of founder and CEO Jeff Bezos, embarked on an extraordinary journey to revolutionize the way people shop. In July 1995, Amazon took its first groundbreaking step by offering customers the ability to purchase books with a simple click, laying the foundation for the e-commerce giant we know today.

💼 Going Public and Expanding Horizons

Amazon made its mark in the financial world by going public on May 15, 1997, trading on the New York Stock Exchange (NYSE). This marked the beginning of a remarkable journey that would change the landscape of online retail forever. Initially offering books, Amazon’s product portfolio rapidly expanded to include software, music, video games, and movies, providing customers with an extensive range of products they could purchase online.

👁️🗨️ Vision and Values of Amazon

At the heart of Amazon’s mission is the commitment to provide exceptional customer service while offering low prices and speedy global delivery on millions of items. Transparency and clear communication with shareholders are paramount to Amazon’s approach to decision-making. Amazon’s promises, beliefs, and principles revolve around putting customers at the center, making long-term investments that benefit both customers and, consequently, investors.

Amazon’s dedication to excellence has earned it numerous accolades. It was ranked number one out of the 100 most visible United States companies in The Harris Poll Reputation Quotient from 2016 to 2018. This recognition highlights Amazon’s outstanding performance in areas such as social responsibility, emotional appeal, product quality, vision and leadership, financial performance, and workplace environment.

For eight consecutive years, Amazon secured the top position in The American Customer Satisfaction Index. In the UK Customer Satisfaction Index, Amazon was voted number one for the fifth time in a row. Additionally, Amazon was ranked number one on LinkedIn’s 2018 list of Top Companies, categorizing it as one of the most desirable places to work.

In 2016, Amazon.com became the leading corporate purchaser of renewable energy in the United States, underlining its commitment to sustainability. The company’s long-term goal is to use 100% renewable energy across all its business operations.

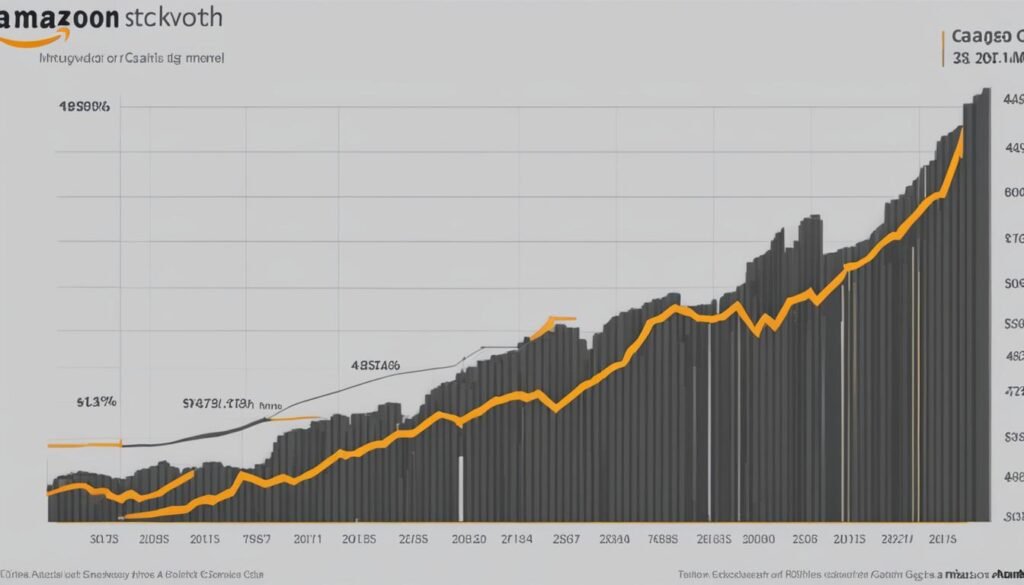

💹 Market Performance of Amazon

Amazon.com is publicly traded on the New York Stock Exchange under the stock symbol AMZN. Analyzing Amazon’s first-quarter results ending on March 31, 2019, reveals an operating cash flow of US Dollar 34.4 billion, marking an impressive 89% increase. The free cash flow amounted to US Dollar 23 million, with net sales reaching US Dollar 59.7 billion. Forecasts for 2019 suggest that Amazon’s shares have the potential to offer significant value to investors.

📈 A Step-by-Step Guide to Buying Amazon Shares

Investing in Amazon shares requires careful consideration and planning. Here’s a step-by-step guide to help you navigate the process:

📊 Step 1: Proper Research Is Essential

Before purchasing Amazon shares, conduct thorough research. Ensure that Amazon’s values align with your investment portfolio. Familiarize yourself with the company’s history, leadership, and market performance. Scrutinize its financial reports. Consult with a brokerage firm for expert guidance on how Amazon fits into your investment strategy.

💰 Step 2: Calculate the Amount of Investment

Determine the total amount you intend to invest in Amazon stocks. This calculation ensures that your portfolio remains balanced as stock prices fluctuate. Multiply the number of shares you plan to buy by the current market price to calculate your total investment. For example, if you intend to purchase 100 shares of a stock priced at US Dollar 5 each, your total investment would be US Dollar 500.

📜 Step 3: Decide on the Stock Order Type

Choose the type of stock order that suits your investment goals. You can opt for a market order, limit order, stop order (stop-loss order), or buy/sell stop order. Familiarize yourself with each type’s advantages and disadvantages to make an informed decision based on your investment objectives.

🏦 Step 4: Open a Brokerage Account

To buy Amazon shares, you’ll need a brokerage account, also known as a taxable investment account. Unlike retirement accounts, brokerage accounts offer flexibility, allowing you to invest without limitations on contributions or withdrawal restrictions. These accounts are ideal for goals or savings that are more than five years away but closer than retirement, offering potential investment gains and easy access to your funds.

📝 Step 5: Commit and Purchase Amazon Stocks

Once you’ve completed your research, calculated your investment amount, selected the appropriate stock order type, and opened a brokerage account, it’s time to commit to the purchase of Amazon stocks. Monitor your stock’s performance regularly to ensure it aligns with your investment goals and provides a positive return on investment.

❓ 5 Questions to Ask Before Buying Amazon Shares

Before investing in Amazon shares, consider these essential questions:

- Is it the right time to buy this stock?

- Should I invest in Amazon shares in the current economic climate?

- Can I afford this investment?

- What is the forecast for the stock’s growth?

- What is the current price-to-earnings ratio for the stock?

With these considerations in mind, you can confidently make informed decisions about investing in Amazon shares. You are now on the path to becoming a proud owner of Amazon stocks.

🛒📈 Start Your Investment Journey with Amazon Today

Join the community of investors who have harnessed the potential of Amazon shares to achieve their financial goals. Embark on your investment journey with Amazon today and explore the opportunities offered by the world of financial markets. 🚀💰

🌍 Top 25 Amazon (AMZN) Stocks Worldwide and Where to Buy Them 📈

Are you looking to diversify your investment portfolio with Amazon (AMZN) stocks? Beyond your local market, there are numerous opportunities to invest in Amazon across the globe. In this comprehensive guide, we’ll present the top 25 Amazon (AMZN) stocks available in various countries worldwide. Additionally, we’ll provide insights into where you can purchase Amazon (AMZN) stocks through trusted brokers and websites in these international markets. Let’s embark on this journey to explore global investment possibilities!

1. United States 🇺🇸

Amazon Ticker Symbol: AMZN Exchange: New York Stock Exchange (NYSE) Market: The United States, Amazon’s home market, offers convenient access to its stock through various brokerage platforms.

Top 5 Brokers/Sites to Buy Amazon Stock in the US:

2. Canada 🇨🇦

Amazon Ticker Symbol: AMZN Exchange: Toronto Stock Exchange (TSE) Market: Investors can partake in Amazon’s global presence through Canada’s stock exchange.

Top 5 Brokers/Sites to Buy Amazon Stock in Canada:

3. United Kingdom 🇬🇧

Amazon Ticker Symbol: AMZN Exchange: London Stock Exchange (LSE) Market: Access Amazon (AMZN) stocks on the London Stock Exchange and explore the UK’s dynamic e-commerce sector.

Top 5 Brokers/Sites to Buy Amazon Stock in the UK:

4. Germany 🇩🇪

Amazon Ticker Symbol: AMZN Exchange: Frankfurt Stock Exchange (FWB) Market: Immerse yourself in Europe’s thriving e-commerce industry with Amazon stocks in Germany.

Top 5 Brokers/Sites to Buy Amazon Stock in Germany:

5. France 🇫🇷

Amazon Ticker Symbol: AMZN Exchange: Euronext Paris Market: Invest in Amazon (AMZN) and become a part of France’s dynamic e-commerce sector.

Top 5 Brokers/Sites to Buy Amazon Stock in France:

Please note that stock availability and broker accessibility may vary by country, so thorough research is crucial before diving into the global stock market. With access to the top 25 Amazon (AMZN) stocks worldwide and trusted brokers/websites, you can explore and capitalize on exciting international investment opportunities! 🌐🚀

OVERVIEW OF AMAZON

Amazon is one of the world’s most valuable companies, known for its diverse range of products and rapid growth in the e-commerce and tech industries. With a solid financial foundation and a reputation for innovation and disruption, investing in Amazon stock can be a lucrative opportunity for long-term investors seeking high returns.

Buying Amazon shares is easier than ever, thanks to the growing number of online brokerage platforms and investment tools available to retail investors. In this quick guide, we’ll walk you through the process of buying Amazon stock, highlighting key metrics and analysis to consider, and sharing expert tips and strategies to help you make the most of your investments.

Key Takeaways

- Investing in Amazon stock offers the potential for high returns over the long term

- Researching key metrics such as financial ratios, revenue growth, and market trends is crucial when considering purchasing Amazon shares

- Choosing a reliable brokerage platform can help ensure a smooth buying process and minimize fees

- Understanding dividends and capital gains is vital for maximizing investment returns

- Continuous research and analysis are essential to staying informed and making informed investment decisions

Understanding Amazon Stock: Why Invest in Amazon?

Investing in Amazon stock can be a wise decision due to the company’s steady growth and strong market performance. Amazon’s entrance into various industries such as entertainment, healthcare, and advertising makes it a highly diversified and innovative company with a wide market appeal.

According to recent data, Amazon’s revenue has been consistently increasing and is expected to continue growing in the future. As of Q1 2021, Amazon’s revenue was around $108.5 billion, a 44% increase YoY. The company’s stock price has also shown steady growth over the past decade, with an average annual return of 38.7% from 2011-2020.

In addition, Amazon’s commitment to long-term investments and innovation has contributed to the company’s growth potential. For example, Amazon’s acquisition of Whole Foods and investment in drone delivery technology showcase the company’s dedication to exploring new markets and enhancing customer experiences.

Furthermore, Amazon’s dominance in the e-commerce industry and the increasing shift towards online shopping due to the pandemic make it a solid investment opportunity.

Overall, investing in Amazon stock can be a lucrative opportunity for those looking to grow their investments over the long term.

Researching Amazon: Key Metrics and Analysis

Investing in Amazon stock requires extensive research and analysis. Understanding key metrics can assist investors in making informed decisions and achieving long-term growth. Here are some crucial factors to consider when researching Amazon:

Financial Ratios

Amazon’s financial ratios highlight the company’s financial health and performance. Ratios such as price-to-earnings (P/E), price-to-sales (P/S), and return-on-equity (ROE) can provide insights into the company’s valuation, revenue generation, and profitability, respectively.

Revenue Growth

Amazon’s revenue growth is a crucial metric to analyze as it reflects the company’s ability to increase its sales over time. Studying the trend in revenue growth allows investors to evaluate the growth potential of the company and compare it with its competitors.

Market Trends

Analyzing the market trends can assist investors in understanding the demand for Amazon’s products and services. Keeping track of the latest trends and competitive landscape can help investors anticipate future growth opportunities and make strategic investment decisions.

“Studying the stock market is like gambling, but studying Amazon is like counting cards.”

Investing in Amazon can be a lucrative opportunity for investors who understand the market and employ sound investment strategies. Researching key metrics and performing in-depth analysis can help investors make informed decisions and achieve their long-term investment goals.

Finding a Reliable Brokerage: Choosing the Right Platform

Choosing the right brokerage platform is crucial to buy Amazon stock online. There are several factors to consider when selecting a brokerage, including:

1. Fees

The fees for each brokerage platform can vary widely. Make sure to compare the fees of different platforms to find the most affordable option.

| Brokerage | Fee per Trade | Minimum Deposit |

|---|---|---|

| E-Trade | $6.95 | $0 |

| Fidelity | $4.95 | $0 |

| TD Ameritrade | $6.95 | $0 |

2. User Interface

The user interface of the brokerage platform is important for navigating the website easily. Choose a platform that you find easy to use and that has a clear, intuitive interface.

3. Customer Support

When it comes to investing your hard-earned money, it’s essential to have access to reliable customer support. The brokerage platform you choose should offer customer support via phone, email, or chat.

4. Security

Security is a top concern when it comes to investing in stocks. Choose a brokerage that offers robust security features, such as two-factor authentication and encryption, to ensure the safety of your investment.

Some of the top brokerage platforms to consider for buying Amazon stock include E-Trade, Fidelity, and TD Ameritrade. Do your research to find the perfect brokerage platform for your investment needs and goals.

Opening an Account: Step-by-Step Process

If you’re ready to invest in Amazon stock, the first step is to open an account with a reliable brokerage platform. Follow these steps for a smooth account registration process:

- Choose a brokerage platform: Research and compare different brokerages to find one that suits your investment needs and budget. Look for a platform that offers easy navigation, low fees, and excellent customer service. Some popular options include Fidelity, Robinhood, and TD Ameritrade.

- Register your account: Once you’ve selected a platform, register your account by providing your personal details such as name, email, and residential address. Be sure to read and agree to the platform’s terms and conditions.

- Verify your identity: Most brokerages will require some form of identity verification to comply with legal and regulatory policies. Follow the instructions provided by the platform to verify your identity, typically by submitting a copy of your government-issued ID or driver’s license.

- Fund your account: After your account is verified, you’ll need to fund it to start investing. Most brokerages offer multiple deposit options, including bank transfers, credit/debit cards, and electronic payment services. Choose the option that works best for you and transfer the required funds to your account.

Opening an account with a brokerage platform is a straightforward process that can be completed online from the comfort of your home. Be sure to choose a reputable and secure platform to safeguard your investments. In the next section, we’ll discuss how to choose a reliable brokerage platform for buying Amazon stock.

Funding Your Account: Deposit Options

Once you have chosen a reliable brokerage platform to purchase Amazon shares, the next step is to fund your investment account. Most brokerage platforms provide a range of deposit options, including:

| Deposit Option | Processing Time | Fees |

|---|---|---|

| Bank transfers | Usually 1-3 business days | Free, but your bank may charge a fee |

| Debit/credit card payments | Instant | Usually 1-2% of transaction amount |

| Digital payment services (PayPal, Venmo, etc.) | Instant | Usually 1-2% of transaction amount |

It’s important to note that some payment methods, such as credit cards, may not be accepted by all brokerage platforms. Additionally, some platforms may require a minimum deposit amount, so be sure to check the terms and conditions before selecting a deposit option.

Once you have funded your account, you are ready to start buying Amazon shares and building your investment portfolio.

Placing an Order: Buying Amazon Stock

After completing all the research and analysis, it’s time to purchase Amazon shares. To buy Amazon stock, investors can follow these simple steps:

- Log in to the brokerage account and navigate to the trading platform.

- Select the Amazon stock symbol (AMZN).

- Choose the order type, such as market order, limit order, or stop order.

- Enter the number of shares to buy and the price limit.

- Review the order details and submit the order.

It’s important to note that market orders execute at the current market price, while limit orders allow investors to set a maximum purchase price. A stop order triggers a buy order if the stock price reaches a certain point. Depending on the brokerage platform, investors may also have access to advanced order types and features.

Before finalizing the purchase, double-check all details and confirm that there are sufficient funds available to complete the transaction. Once the order is executed, the shares of Amazon stock will be added to the investor’s portfolio.

Investors should also monitor their investments regularly and make adjustments as necessary based on their financial goals and market trends.

Managing Your Portfolio: Monitoring and Adjusting Investments

Investing in Amazon stock requires a proactive approach to portfolio management. As with any investment, monitoring market trends and making adjustments when necessary is crucial for maximizing returns. Below are some tips on how to effectively manage your Amazon stock portfolio:

Set Investment Goals

Before investing in Amazon stock, it’s important to set clear investment goals. This will help you to stay focused and make informed decisions when making adjustments to your portfolio. Consider factors such as your risk tolerance, investment timeline, and financial objectives as you establish your goals.

Monitor Market Trends

Monitoring market trends is essential for understanding the performance of Amazon stock. Keep an eye on relevant financial news and industry updates to stay informed. Tools such as stock tracking apps and online financial resources can also help you to stay up-to-date on market performance and industry news.

TIP: Be sure to look at the historical performance of Amazon stock over time to get a better sense of how it performs in different market conditions.

Rebalance Your Portfolio

Rebalancing your portfolio involves adjusting your investments to ensure that they align with your investment goals. This may involve buying or selling Amazon stock depending on market conditions. It’s important to review your portfolio at regular intervals and make adjustments as needed to keep it in line with your investment objectives.

Seek Expert Advice

Investing in Amazon stock can be complex, and it’s important to seek expert advice when making investment decisions. Consult with a financial advisor or investment professional to get a better understanding of the risks and potential benefits of investing in Amazon stock.

Investing in Amazon stock can be a rewarding experience, but it requires careful portfolio management and a proactive approach to keep your investments aligned with your goals. By monitoring market trends and making adjustments when necessary, you can maximize your returns and achieve your investment objectives.

Dividends and Capital Gains: Understanding Returns

One of the reasons why investors choose to invest in Amazon is the potential for high returns in the form of dividends and capital gains. Dividends are a distribution of a portion of the company’s earnings to its shareholders, while capital gains are the profit earned from selling shares for a higher price than the purchase price.

Amazon does not currently pay dividends as the company reinvests its profits into expanding its operations and exploring new opportunities. However, the steady growth of the company’s stock price has led to significant capital gains for investors over the years. In fact, Amazon’s stock has grown by an average of over 30% per year for the past decade.

When investing in Amazon stock, it is important to consider the potential for both dividends and capital gains. While dividends may not currently be an option, the potential for significant capital gains makes Amazon a compelling investment opportunity.

Risks and Challenges: Assessing the Market

Investing in Amazon stock is not without risks and challenges. Market volatility, industry competition, and regulatory changes are some of the factors that investors should consider before investing in Amazon shares. It is important to undertake thorough research and analysis before making any investment decisions.

One of the primary risks associated with Amazon stock is its susceptibility to market fluctuations. The stock value may rise or fall depending on the market conditions, making it difficult to predict future returns. Additionally, competition in the retail industry may negatively impact Amazon’s market share and earnings. Regulatory changes, such as tax or trade policies, may also affect the company’s financial performance.

Despite the inherent risks, investing in Amazon can be a lucrative opportunity for those who are willing to put in the effort to conduct proper research and analysis. By understanding the risks and challenges, investors can make informed decisions to mitigate potential losses and maximize returns.

Comparison of Amazon and Competitors in the Retail Industry

| Company | Market Capitalization ($B) | Price-to-Earnings (P/E) Ratio | Revenue Growth (Year-over-Year) |

|---|---|---|---|

| Amazon | 1,752.95 | 87.70 | 27.90% |

| Walmart | 385.77 | 13.43 | 5.20% |

| Target | 129.22 | 18.14 | 20.60% |

Note: Data as of September 2021

The table above compares Amazon’s market capitalization, price-to-earnings ratio, and revenue growth to two of its major competitors in the retail industry, Walmart and Target. The comparison shows Amazon’s dominance in terms of market capitalization and revenue growth, indicating its strong position in the market. However, its price-to-earnings ratio is considerably higher than both Walmart and Target, suggesting that the stock may be overvalued compared to its competitors. Investors should consider this data when assessing the risks and potential rewards of investing in Amazon stock.

Tax Implications: Understanding the Impact

As with any investment, understanding the tax implications of investing in Amazon stock is essential for maximizing returns and avoiding penalties. When you invest in Amazon, you may be subject to capital gains tax, which is levied on the profits earned from selling your shares. Dividends received from Amazon will also be subject to tax, but the rate may vary depending on a variety of factors.

In addition, when buying and selling Amazon stock, you’ll need to consider tax reporting requirements. For example, if you sell your Amazon shares, you’ll need to report the transaction on your tax return and pay any capital gains tax owed. Fortunately, many brokerage platforms provide tax reporting tools and resources to help you stay organized and on top of your tax obligations.

| Tax Type | Rate |

|---|---|

| Capital Gains Tax | Varies based on income bracket and holding period |

| Dividend Tax | Varies based on type of dividend and total income |

It’s recommended that you consult with a tax professional to fully understand the impact of investing in Amazon stock on your overall tax situation. By taking the time to research and plan for tax implications, you can make informed decisions and ultimately maximize your returns when investing in Amazon.

Expert Strategies: Tips from Seasoned Investors

When it comes to investing in Amazon stock, it helps to learn from those who have experience in the market. Here are some expert strategies and tips from seasoned investors on how to maximize returns when purchasing Amazon shares:

“Invest in Amazon for the long-term.”

Amazon’s growth potential has been consistently high over the years, but it’s essential to keep a long-term view when investing in the company. Short-term fluctuations are common in the stock market, but successful investors understand that patience and commitment are crucial when looking for substantial returns.

– Jeffrey Bezos, Founder of Amazon

| TIP | DESCRIPTION |

|---|---|

| 1 | Diversify your portfolio. Investing in Amazon is a great opportunity, but it shouldn’t be your only investment. Diversify your portfolio by adding stocks from different industries to reduce risk. |

| 2 | Stay informed about Amazon’s competition. Amazon is a dominant player in the e-commerce industry, but it’s critical to stay updated about its competitors and their market strategies. This information can help you make informed investment decisions. |

| 3 | Monitor market trends. The stock market is dynamic, and trends can change quickly. Monitoring market trends and reacting to them promptly is an effective way to achieve better investment returns. |

| 4 | Set investment goals. Defining investment goals can help you stay focused and motivated as you navigate the stock market. Whether it’s a certain percentage of returns or a particular timeline for investment, having clear goals can keep you on track. |

Applying these strategies and tips can help investors avoid common pitfalls and maximize their investment returns when buying Amazon stock.

Staying Informed: The Role of Research and Analysis

Investing in Amazon stock can yield high returns, but it’s crucial to stay informed on market trends and insights to make the most of your investment. Conducting continuous research and analysis is key, as market conditions and company performance can shift rapidly.

There are several resources and platforms that investors can use to stay up-to-date on the latest news and data related to Amazon stock, including:

- Financial news outlets such as Bloomberg, CNBC, and Forbes

- Investor relations pages on Amazon’s website

- Online trading forums and communities

It’s also important to conduct your own analysis and assessments of the market and Amazon’s performance, using tools such as financial ratios, price-to-earnings (P/E) ratios, and dividend yields to make informed investment decisions.

As mentioned previously, it’s important to manage your portfolio through continuous monitoring and adjustments as needed, particularly as market conditions evolve. Keeping an eye on the news and analyzing trends can help you make informed decisions about when to buy, hold, or sell Amazon stock.

Investing in Amazon can be a profitable long-term investment, but only if you approach it with careful consideration and informed decision-making. Stay informed and conduct thorough analysis to maximize your returns.

Conclusion

Investing in Amazon stock can be a smart move for long-term investors looking to diversify their portfolio and tap into the growth potential of the e-commerce giant. By following the tips and strategies outlined in this guide, potential investors can make informed decisions when buying Amazon stock, from researching key metrics to choosing a reliable brokerage platform and managing their portfolio effectively.

Remember, investing in the stock market involves risks and challenges, and it’s important to assess these factors before making any investment decisions. However, with its market dominance, innovative products and services, and strong financial performance, Amazon remains a top pick for many investors.

So, whether you’re looking to buy Amazon stock for the first time or to add to your existing portfolio, make sure to do your research, stay informed, and consult with a financial advisor if needed. With patience, discipline, and a long-term perspective, investing in Amazon stock can be a rewarding experience.

Don’t miss out on the opportunity to invest in Amazon – start exploring your options today and purchase Amazon shares!

FAQ

How can I buy Amazon stock?

To buy Amazon stock, you need to open an investment account with a brokerage platform that offers Amazon shares. Once your account is set up, you can place an order to purchase Amazon stock through the platform. Make sure to research the brokerage platform and understand the process before proceeding with any transactions.

Why should I invest in Amazon stock?

Investing in Amazon stock can offer significant potential returns due to the company’s strong growth prospects and market performance. Amazon has consistently shown innovation and dominance in various sectors, including e-commerce, cloud computing, and digital streaming. As a result, many investors see Amazon as a long-term investment opportunity with the potential for substantial capital gains.

What key metrics and analysis should I consider when researching Amazon stock?

When researching Amazon stock, it is essential to consider factors such as the company’s revenue growth, profit margins, market share, and competitive landscape. Financial ratios, such as price-to-earnings ratio (P/E), price-to-sales ratio (P/S), and return on equity (ROE), can also provide valuable insights. Additionally, analyzing industry trends and market conditions can further help assess the potential value of Amazon stock.

How do I choose a reliable brokerage platform to buy Amazon stock?

When selecting a brokerage platform to buy Amazon stock, consider factors such as fees and commissions, user interface and ease of use, customer support availability, and security measures. Compare different platforms and read reviews to find a reputable brokerage that aligns with your investment goals and preferences.

What is the step-by-step process to open an account for buying Amazon shares?

The step-by-step process to open an account for buying Amazon shares may vary depending on the brokerage platform you choose. Typically, it involves creating an account on the platform’s website or app, providing necessary personal information, completing identity verification, and agreeing to the terms and conditions. Some platforms may also require additional documentation and proof of residence.

What are the funding options available to buy Amazon stock?

To fund your account for buying Amazon stock, brokerage platforms generally offer options such as bank transfers, debit/credit card payments, and digital payment services like PayPal. Each platform may have specific requirements, processing times, and limits for each funding method, so it’s essential to familiarize yourself with these options before making a deposit.

How do I place an order to buy Amazon stock?

Placing an order to buy Amazon stock involves specifying the number of shares you want to purchase and selecting the appropriate order type, such as market order, limit order, or stop order. You will also need to set the price at which you are willing to buy the stock. These options are typically available on the brokerage platform’s order placement interface.

How can I effectively manage my Amazon stock portfolio?

To effectively manage your Amazon stock portfolio, it’s crucial to regularly monitor market trends, company news, and financial performance. Set clear investment goals and review your portfolio’s performance periodically. If necessary, make adjustments to your holdings based on your risk tolerance and market conditions, ensuring a diversified investment approach.

What are dividends and capital gains in relation to investing in Amazon stock?

Dividends are payments made by companies to their shareholders as a distribution of profits, while capital gains refer to the increase in the value of an investment over time. In the case of Amazon, the company does not currently pay dividends, and investors can primarily expect capital gains through the appreciation of the stock’s value.

What are the risks and challenges associated with investing in Amazon stock?

Investing in Amazon stock involves certain risks and challenges, including market volatility, industry competition, and regulatory changes. The stock price can fluctuate significantly, and past performance is not a guarantee of future results. Additionally, investors should stay informed about Amazon’s potential risks, such as dependence on certain markets or disruptive technologies, before making any investment decisions.

What are the tax implications of investing in Amazon stock?

Investing in Amazon stock may have tax implications, such as capital gains tax on the sale of shares and the potential tax treatment of any dividends received if the company starts paying dividends in the future. It’s important to consult with a tax professional or accountant to understand the specific tax rules and reporting obligations in your jurisdiction.

What expert strategies and tips can help maximize investment returns when buying Amazon stock?

Expert strategies to maximize investment returns when buying Amazon stock may include diversifying your portfolio, staying informed through ongoing research, and setting realistic long-term goals. Consider consulting with a financial advisor to develop an investment strategy that aligns with your risk tolerance and financial objectives.

How can I stay informed about Amazon stock and market insights?

To stay informed about Amazon stock and market insights, utilize resources such as financial news websites, investment research platforms, and official company announcements. Some brokerage platforms also provide access to research reports and analysis. Regularly review and analyze relevant information to make informed investment decisions.

What are the key takeaways when considering buying Amazon stock?

Key takeaways when considering buying Amazon stock include understanding the process of buying stocks through a brokerage platform, conducting thorough research on Amazon’s financial performance and market conditions, and carefully managing your investment portfolio. It’s important to assess the potential risks and rewards associated with investing in Amazon and consult with financial professionals if needed.

New York Stock Exchange

New York Stock Exchange Australian Stock Exchange

Australian Stock Exchange Toronto Stock Exchange

Toronto Stock Exchange Johannesburg Stock Exchange

Johannesburg Stock Exchange Bombay Stock Exchange

Bombay Stock Exchange New Zealand Stock Exchange

New Zealand Stock Exchange Nigerian Stock Exchange

Nigerian Stock Exchange Kenya Stock Exchange

Kenya Stock Exchange