ActivTrades broker

ActivTrades broker reviews and test – How good is the platform?

Most aspiring traders nowadays are looking for a trusted CFD Broker that offers not just forex pairs, but also the best assistance and support they can get from the company. ActivTrades is one of the most developed Online Brokers and commits to giving excellent customer service and support to their clients. In this review, we will discuss what it is like to trade with ActivTrades and why it is one of the trusted brokers in the trading industry.

What is ActivTrades – The online broker presented:

ActivTrades is a respected global online broker that was founded in Switzerland in the year 2001. It provides more than 450 CFDs on Forex, Indices, Commodities, Financials, Shares, ETFs, and Spread Betting. The company made a strategic decision to move its headquarters to London (known as the world’s financial district) from Switzerland in 2005. Since then, ActivTrades was able to meet the needs of various markets, including Europe, Asia, and South America. It has gained immediate global appeal and has continued to expand.

The brand’s non-stop development was seen and recognized by the Sunday Times Fast Track 100 and named it as the 90th fastest growing company in the UK for 2017. The company offers a range of enhanced financial products and services, with competitive spreads such as 0.5 pips on EUR/USD and 35 points on Gold.

The company aims to deliver exceptional customer support to its clients, provide the best and fastest execution, offers educational materials that will surely be a great help to its clients, provide its customers with the safest environment of their funds, and continues to innovate and meet the evolving needs of the market.

ActivTrades continues its way to lead as a highly acclaimed Forex Broker and CFD Broker in the trading industry.

Facts about ActivTrades:

| ⭐ Rating: | 4.9 / 5 |

| 🏛 Founded: | 2001 |

| 💻 Trading platforms: | ActiveTrader, MetaTrader 4, MetaTrader 5 |

| 💰 Minimum deposit: | $1,000 |

| 💱 Account currencies: | EUR, USD, GBP, CHF |

| 💸 Withdrawal limit: | None |

| 📉 Minimum trade amount: | $1,000 / 0.01 lot |

| ⌨️ Demo account: | Yes, $10,000 limit |

| 🕌 Islamic account: | Yes |

| 🎁 Bonus: | No bonus |

| 📊 Assets: | Forex, shares, indices, cryptocurrencies, ETFs, commodities, bonds |

| 💳 Payment methods: | Mastercard, Visa, Neteller, Skrill, Astropay, Bank Transfer |

| 🧮 Fees: | starting at 0.8 pip spread, variable overnight fees |

| 📞 Support: | 24/5 via chat, phone or e-mail |

| 🌎 Languages: | 14 languages |

➔ Open your free trading account with ActivTrades now

(Risk warning: 66 – 79% of retail CFD accounts lose money)

What are the pros and cons of ActiveTraders

Every broker has its advantages and disadvantages, but after testing many brokers extensively, these are the most important advantages and disadvantages of ActiveTraders.

| Pros of Active Traders | Cons of Active Traders |

| ✔ Trusted and reputated broker | ✘ The complexity of the platform comes with a steep learning curve for beginners |

| ✔ Competitive Plattform Fees | ✘ User interface could be more intuitive |

| ✔ Many advanced tools and educational ressources available | ✘ Demo trading account is limited to $10,000 and 30-days per user |

| ✔ Helpful and professional customer support | |

| ✔ Dedicated account manager for professional traders |

Is ActivTrades regulated? – Regulation and safety for customers

Nowadays, there are a lot of scams revolving on the internet and most of these scammers target people who are interested in online trading. In order to avoid getting scammed, you need to know if the CFD Broker that you would be investing with is regulated. The regulation is a validation by an official that authorized the company that passed certain criteria to be a trusted broker. ActivTrades is authorized and regulated by a high regulator, which is FCA which stands for ‘Financial Conduct Authority’. This regulator is known as one of the famous regulators in the trading industry.

ActivTrades is regulated by:

- Financial Conduct Authority (FCA)

- Commission de Surveillance du Secteur Financier (CSFF)

- Securities Commission of the Bahamas (SCB)

- Portugues Securities Market Commission (CMVM)

- Central Bank of Brazil (Bacen)

Financial security

The primary objective of ActivTrades has put first the interests of its client and make sure that the client’s balance will not go negative. The company offers a Balance Protection Policy and will credit the client’s account to a zero balance if the account goes into negative as a result of trading activity, and it applies to multiple accounts as well. Client funds are kept in a segregated client account.

ActivTrades PLC is a member of the Financial Services Compensation Scheme (FSCS) and it fully implements Enhanced Segregation of Client Money, Treating Customers Fairly (TCF), and ICCAP.

As a member of FSCS, it covers, in the unlikely event of default by the broker, 100% of the first £85,000 deposited by the client. Also, the brand has additional insurance to protect customers up to £1,000,000. ActivTrades clients can benefit from this extra security exceeding the FSCS threshold by up to £1,000,000 per client – via Excess of FSCS Insurance.

Summary of the regulation and financial security:

- Authorized and regulated by FCA

- Segregated customer funds

- Financial Services Compensation Scheme £85,000

- Additional insurance protects customers up to £1,000,000

- Treating Customers Fairly (TCF)

- ICAAP

➔ Open your free trading account with ActivTrades now

(Risk warning: 66 – 79% of retail CFD accounts lose money)

Is ActiveTraders easy to use?

Usability and user experience are key elements for trading platforms. In this section, we tested and rated the user experience from ActiveTraders, particularly for trading beginners. Is the platform mobile-friendly, intuitive, and easy to navigate? Each plattform offers customizable features, letting users optimize the trading platform to fit their particular needs and preferences, therefore the usability rating as always partly based on personal preferences.

| Criteria | Rating |

| General Website Design and Setup | ★★★★★ clean and professional website, optimized for computer and mobile devices |

| Sign-up Process | ★★★★★ smooth and self-explanatory sign-up process |

| Usability of trading area | ★★★ Trading area in SmartTraders could be easier to navigate around |

| Usability of mobile app | ★★★ The mobile app has some flaws and is not always working smoothly. |

Review of the trading conditions for traders

ActivTrades offers tight spreads, best execution, and no hidden fees which gives you the capacity to fit your trading potential to the highest level. The brand promotes the safety of clients’ funds by segregating them from the own company’s funds and promoting client protection programs. As a non-dealing desk broker, there is no human intervention in the client’s trades. The firm offers its customers access to exclusive tools that can be very useful and helpful in the trader’s account (including the following: SmartForecast | SmartTemplate | SmartPattern | SmartLines | Pivot Points indicator). With this, traders can have a better experience with online trading. ActivTrades also promotes no hidden fees and is transparent to their clients with their investments.

| ASSET: | SPREAD FROM (VARIABLE): |

|---|---|

| EUR/USD | 0.5 pips |

| GBP/USD | 0.8 pips |

| USD/JPY | 0.5 pips |

| UK100 | 0.8 points |

| S&P500 | 0.23 points |

It is known to be one of the trusted brokers that offers forex pairs in a very competitive spread variable. You can trade FTSE from 0,45 spread and all major Forex pairs from 0,50 pips. Best and fast execution is being promoted by this broker and offers traders the ability to trade more than 500 CFDs on Forex, Indices, Commodities, Financials, Shares, ETFs, and Spread Betting. ActivTrades also offers user-friendly platforms that you can choose from which fits your trading style.

Trading conditions:

- Free demo account

- Spreads starting 0.45 pips

- Minimum deposit 1,000$

- 450+ assets (forex, commodities, stocks, ETFs, indices, cryptocurrencies)

- No-dealing desk broker

- Very fast execution

- No hidden fees

The company has won various awards since 2001 for its excellence. In the year 2013, ActivTrades won 3 awards. It is voted as one of the UK’s 100 fastest-growing companies by the Investec Hot 100, was shortlisted as “Company of the Year” in the prestigious UK Growing Business Award, and named as ‘est Forex Customer Service’. The year 2016, it gathered two awards: “Corporate visions’ CEO of the month” and “IAIR Best Forex Broker of the Year UK”. In the following year, 2017, ActivTrades won “ADVFN International Financial Awards 2017 in the category of Best Online Trading Services”, “Online Personal Wealth Awards’ Best Non-Dealing Desk Broker”, “Shared magazine awards as Best Online Trading Services”, and “Le Fonti award for Forex Broker of the Year”. Just this 2018, it was given an award for “Best Online Trading Services” in ADVFN International Financial Award.

➔ Open your free trading account with ActivTrades now

(Risk warning: 66 – 79% of retail CFD accounts lose money)

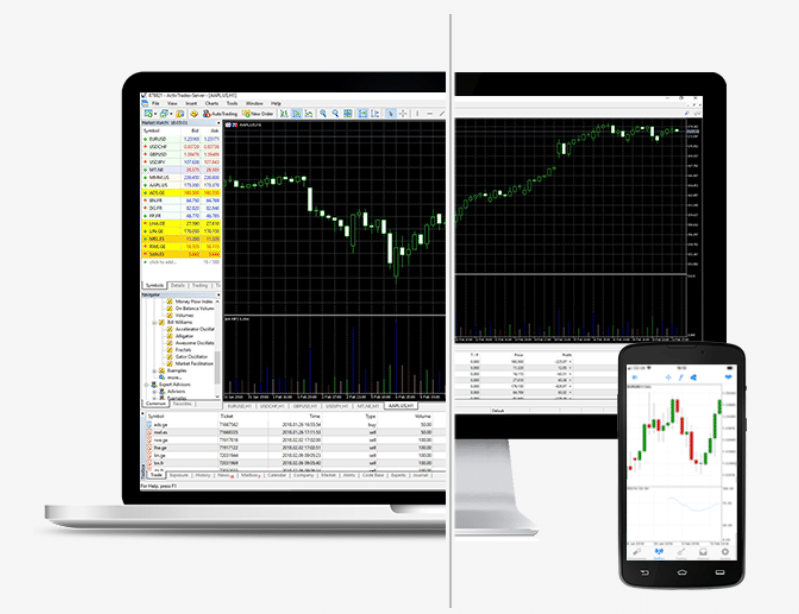

Test of the ActivTrades trading platform

ActivTrades offers advanced and popular different types of trading platforms. These platforms can be used for desktop (or web), mobile, and tablet. One is ActiveTrader and the other is MetaTrader platforms (MetaTrader 4 and MetaTrader 5).

ActivTrades offers the following platforms:

ActivTrader platform

ActivTrader Platform is an enhanced platform designed for any type of trader and inspired by pros. This platform is simple and easy to use. It utilizes the latest technology and advanced functionalities to create an immersive trading experience. With this platform, you can trade over 500 CFDs including Forex, Commodities, Financial and Indices, Options, Shares, and ETFs. Also, ActivTrader gives access to more than 1,000 instruments, including CFDs on Shares. It features trailing stop, partial close, instant trading from charts, and market sentiment.

You can use this with desktop, mobile, and tablet. For the web platform, it supports the browsers Google Chrome, Mozilla Firefox, and Microsoft Edge. When you want to download it on your mobile or tablet, you can download it from GooglePlay (for Android) or AppStore (for iOS). Specification varies, for Android Supported OS is at least 5 or greater, and for iOS Supported OS is at least 10.0 or greater.

➔ Open your free trading account with ActivTrades now

(Risk warning: 66 – 79% of retail CFD accounts lose money)

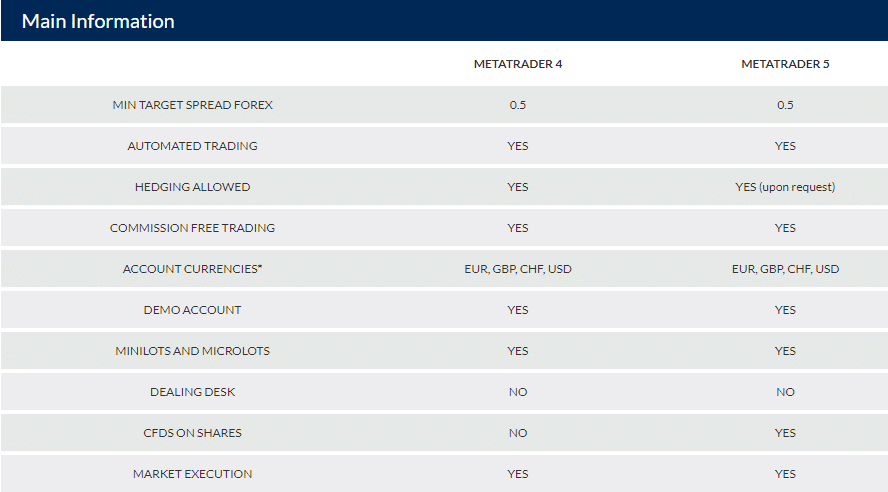

MetaTrader 4 and MetaTrader 5

MetaTrader platforms are the most recommended choice for experienced traders. This platform is popular among traders and has two different types: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both feature one-click and automated trading, micro-lot and mini lot trading, historical data center and strategy tester, price alerts, and trailing stop, and it supports 21 languages.

MetaTrader 4 is one of the most popular and reliable trading platforms for Forex trading. It is considered the market standard platform. It is a user-friendly platform with enhanced security and offers advanced technology for trading Forex, Metals, Indices, Fixed Income, and Commodities. This platform allows investors to automate their strategies with Experts Advisors (EAs). It offers the option to use third-party EAs, or you can develop your own, as well as other technical indicators. It is known for its customizable charting capabilities and pre-set templates which you can base on your personal preferences. You can use this platform on your desktop (or web), mobile, and tablet.

Mobile trading is the handiest way to use this platform due to the fact that you can trade anywhere you are and anytime you want. MT4 mobile app promotes speed, functionality, and performance in your hands. You can track your portfolio at any time, see the market movements, and allows you to view multiple financial instruments without any struggle, wherever, and whenever you wish. It is packed with market-leading functionalities and an intuitive interface design. MetaTrader 4 mobile a user-friendly app that brings freedom and simplicity to your pocket. You can download it from either GooglePlay (Android) or AppStore (iOS).

The desktop version of MetaTrader 4 provides all the functionalities you need. This version allows you to run Expert Advisors (EAs) and automate trading in the very most straightforward way, which lets you enjoy a smooth trading experience. It gives you access to one-click trading, unlimited charts, technical indicators, and more. On the other hand, MetaTrader 4 Web platform is the browser-based version of MetaTrader. You don’t need to download it or install the software. It lets you trade in any computer or tablet device that is connected to the Internet. It features an easy-to-use interface. MT4 Web is a great solution for a trader’s daily trading.

MetaTrader 5 is an online trading platform that is more advanced, more powerful, and has more instruments. It features new and extended characteristics that make online trading more professional and precise. MT5 allows you to access over 450 CFDs on stocks, ETFs, and the rest of the products available in MetaTrader 4. This platform is a flexible platform for FX and CFD trading. It lets you net off positions by reversing your current trade. When you open several positions in the same contract, your positions will be consolidated, letting a clear “First in First out” netting of open positions.

With MT5, traders can analyze the market, check their trading accounts, and issue their orders. In terms of usability, functionality, and range of applications, MT5 is intended for both first-time users and professional users because it can be expanded to include nearly any number of additional instruments and programs. MetaTrader 5 is the first choice for most traders because it is easy to use and also offers a range of add-ons to enhance the trading experience. You can use this platform version as well on your desktop (or web), mobile, and tablet.

➔ Open your free trading account with ActivTrades now

(Risk warning: 66 – 79% of retail CFD accounts lose money)

Please note that market data for CFDs on shares is displayed with a 15 minutes delay for the MT5 demo accounts.

Metatrader 4 and MetaTrader 5 have their own unique qualities and advantages. MT4 has no economic calendar and exposure tab, but MT5 does. The tick Chart of MT4 is standard, while MT5 is extended. MT5 has 21 timeframes and MT4 has only 9. With timeframes, MT4 features only 9, while MT5 features 21. Both MT4 and MT5 margin applied on hedged Forex positions is 10%.

Facts about the platforms:

- Can be used on desktop, web, tablet, or mobile

- User-friendly

- Advanced and popular platforms

- Reliable software

- Fast and secure

- Has new features and enhanced customization capabilities

➔ Open your free trading account with ActivTrades now

(Risk warning: 66 – 79% of retail CFD accounts lose money)

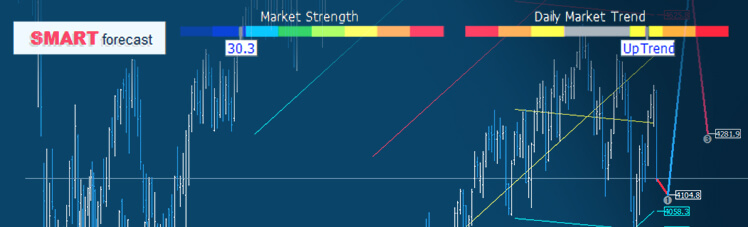

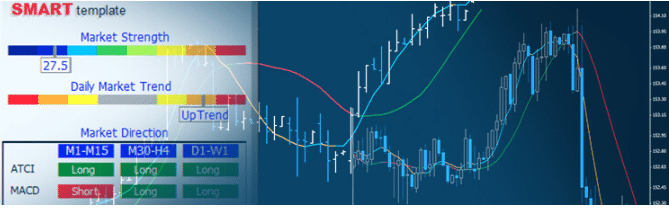

Professional charting and analysis is possible

ActivTrades offers modules of the most advanced technical analysis tools that are available on the platforms that you can use in trading with them as your broker. It aims to give clients a thorough understanding of how the market’s volatility and trends affect your trades. Also, together with charting, it gives traders an edge to indicate which or what movements should be taken next.

ActivTrades’ SmartForecast is one of the most advanced technical analysis tools available in MetaTrader4. With chart retracements and market trend analysis, this indicator offers a simple overview of markets. It automatically calculates both short and long-term resistance and support. It also indicates volatility levels and market trends. However, this indicator gives you a price evolution scenario, which is with three targets that change in real-time.

The SmartForecast gives you three consecutive target prices. Price 1 is reckoned using short-term resistance and support lines, while Price 2 is reckoned using long-term resistance and support lines. And finally, Price 3 is reckoned based on the assumption that Price 2 is confirmed. Please note that the places on the chart are not indicative. The time might not determine whether those prices will be reached and/or can be reached at a certain time.

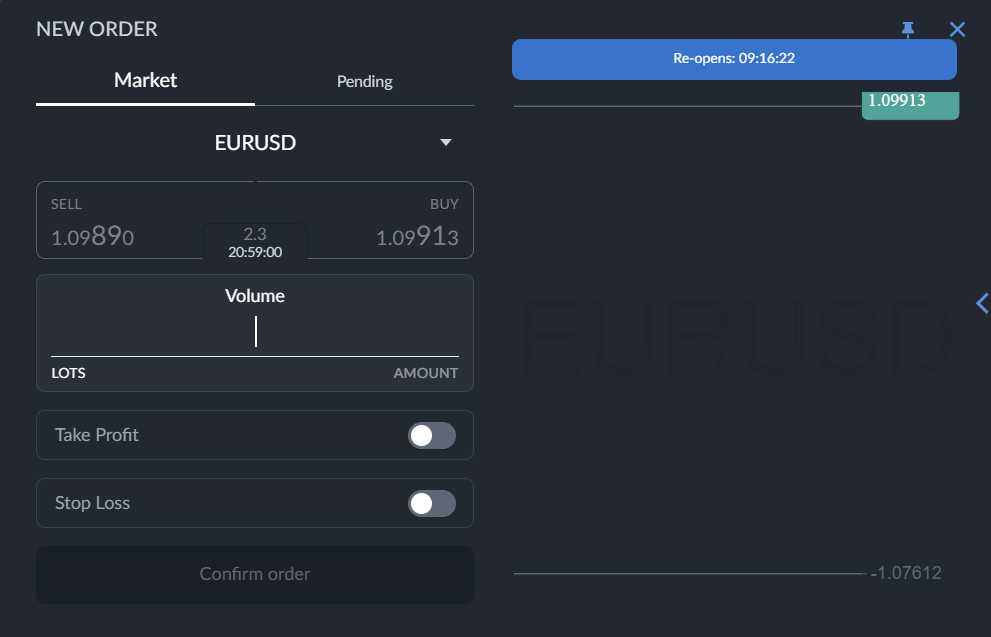

ActivTrades’ SmartOrder is a developed application by the firm. It extends and enhances the functions of the MetaTrader 4 and 5 platforms. Namely ‘Smart Order 2’, is designed to increase the trading speed of the trader and improve the process of managing the trader’s positions. These features improved integration between the trading platform and the application. It is a user-friendly interface and gives the trader the ability to use multiple functions simultaneously. It lets you level up your trading potential and targets while keeping track of the markets. This app is completely free of charge to all existing clients of ActivTrades. But, if you are not yet a client of the firm, you can open a 30 day Demo account and test SmartOrder.

ActivTrades’ SmartLine is a newly developed add-on that makes monitoring price movement and trend formation hassle-free. It is a state-of-the-art, yet user-friendly, application for MetaTrader 4/5. It enables automated execution in the chart based on pre-defined Trendlines. It is a tool that saves you time and identifies entry points for buy and sell orders, with the capability of giving you a precise execution with no delay in time. With this tool, traders can manage multiple charts, with pre-set automatic Stop Loss / Take profit set up for each one of them. It is an indicator for both Trendline’s unique label and price level covered, which also allows a trader to enter volume and direction for their order.

➔ Open your free trading account with ActivTrades now

(Risk warning: 66 – 79% of retail CFD accounts lose money)

ActivTrades’ SmartPattern is a powerful tool exclusively available for ActivTrades Live clients. This is an indicator of the MetaTrader Platforms (MetaTrader 4 and MetaTrader 5). It is designed to fit all types of traders (beginner level to expert). This tool can be used on all chart timeframes to increase forecast possibilities. It automatically detects chart patterns, scans historical data to find recurrences, and generates detailed statistics about potential upcoming market movements.

ActivTrades’ SmartTemplate is the newest add-on developed by Activtrades. It is an extensive indicator tool for MetaTrader 4 that helps traders make calculated trading decisions. This indicator offers simple but highly effective features, which indicates unique long and short trading opportunities based on chart signals. It provides clear bar chart signals and defines the clear time frame to trade.

ActivTrades’ Pivot Points Indicator is often used by professional traders. It is a predictive indicator of market movements and trends. This is famous in both MetaTrader platforms (MetaTrader 4 and MetaTrader 5), with 3 levels of Support and Resistance

Mobile Trading (App) review

Most traders want to make out the best of their time wherever they are and whenever they can. ActivTrades offers the benefit of doing this with its mobile trading platform. ActivTrades mobile trading platform delivers speed, functionality, and performance. Traders can track the movements of the market and react to it wherever they are and whenever they can.

It also allows traders to view multiple financial instruments and it is designed with an intuitive interface that packs with market-leading functionality. ActivTrades mobile gives simplicity and brings freedom to the trader’s hands and making a better trading experience. MetaTrader 4 and MetaTrader 5 are the most popular platforms that are being used by traders for mobile trading, but the ActivTrader platform has also mobile trading capacity. This ActivTrades mobile trading app is available on GooglePlay (for Android) and in AppStore (for iOS).

Features of App:

- Customizable

- Display Charts

- Read Market News

- Allows you to use all types of orders

- On-the-go trading insights

- Free Demo Account

- Search and select instruments

- Advanced and Powerful Trading Tools

- Customer Support

➔ Open your free trading account with ActivTrades now

(Risk warning: 66 – 79% of retail CFD accounts lose money)

Trading tutorial: How to trade with ActivTrades

In trading, you need to choose the market you want to trade on and take action. Always remember that when buying any buy order, which is on a stake at rising prices and executed an offer price, with a sell order, that is, a stake on a falling price, is executed at the respective bid price. In addition to the price change at any position, a spread, which is the difference between the offer price and buying rate, will have an effect.

When you make a trade, first you need to choose the asset that you want. Then, analyze the asset you selected and make a forecast of the price movement. After, open the order mask and ready to place your position and choose the order volume you prefer. Then click either ‘Buy’ or ‘Sell’ on the asset you want.

Step by step trading tutorial:

- Choose an asset

- Analyze the asset and make a forecast of the price movement

- Open the order mask

- Customize your position

- Choose the order volume

- Buy or sell the asset you want

How to open your account

Account opening with ActivTrades is very easy and simple. You just need to fill out the online application form from ActivTrades’ official website (www.activtrades.com), then an agent from their customer support will contact you for what the necessary documents required. If you worry about the security of your personal data, ActivTrades PLC takes the privacy and protection of its clients very seriously.

They don’t deploy the same certificate-based SSL cryptographic protocol used by the largest banks and online retailers for securing data submitted through the Personal Area and the Online Application. If you have any questions with regards to data protection, you can contact the company’s support (by phone on +44 (0)207 680 7300 or send a mail to info@activtrades.com) for additional information. Accounts are usually opened within 24hrs when the correct supporting documents are submitted. Accounts with ActivTrades are in the following currencies: EUR, GBP, CHF or USD.

Please note that the maximum number of accounts per client is 10. However, some exceptions can be made on a case-by-case basis.

Demo Account

ActivTrades’ demo accounts are always a fair copy of the real market, as the prices are in real-time. You can definitely get a free demo account with ActivTrades with its ActiveTrader Platform and MetaTrader Platforms (MT4 and MT5). Demo accounts are designed for traders to familiarise themselves with all the platform functionalities using virtual money and without financial risk. ActivTrades demo account is valid for 30 days. We highly recommend first getting a demo account before going live to avoid unintentional trading execution and investments.

➔ Open your free trading account with ActivTrades now

(Risk warning: 66 – 79% of retail CFD accounts lose money)

Account types:

ActivTrades offer 4 types of quality accounts: Free Demo Account, Individual Account, Professional Account, and Islamic Account. The last one comes with no interest for contracts lasting longer than 24 hours. Additionally, there are also no rollover commissions for that specific account type.

Free demo account:

A free Demo Account is a practice account with a fair copy of the real market, and the prices are in real-time. This account has virtual funds that can be used to train your trading skills and lets you be familiarised with how the platforms work with Activetrades. All platforms are available on a free demo account which is ActivTrader Platforms and MetaTrader Platforms (MT4 and MT5). ActivTrades Free Demo Account is valid for 30 days and is recommended to use first in order to avoid unintentional trades.

Individual account:

An Individual Account is an efficient account for unique traders. It is the standard account to trade with ActivTrades. It is recommended to account for those who would like to go live trading and don’t require any criteria. You can easily get this account with ActivTrades and can trade without any ease. This is a real account (live trading account) and would need real money funds to operate. All ActivTrades Platforms can be used in this account.

Professional account:

A professional Account is a higher form of ActivTrades account that requires criteria in order to be eligible for it. A trader needs to apply for this certain account and must meet at least two out of the three criteria. One is that a trader must have carried out significantly large transactions, in the relevant market, on average 10 per quarter over the previous four quarters. The second is that the size of a trader’s financial instrument portfolio, including cash deposits and financial assets, must exceed 500,000 EUR. This might include but is not limited to, saving accounts, options, shares portfolios, equities, and investment in funds. And third, a trader currently works or has worked in the financial sector for at least one year in a professional position, which requires knowledge of the transactions or services envisaged.

Please refer to the mask below for a quick overview of the differences between individual and professional accounts.

| Individual Account | Professional Account | |

| Ultra Fast Execution | ✔ Less than 0.0004 sec average execution time | ✔ Less than 0.0004 sec average execution time |

| No Requotes | ✔ Best available price guaranteed | ✔ Best available price guaranteed |

| Negative Balance Protection | ✔ Negative balance protection included | ✔ Negative balance protection included |

| Enhanced Fund Insurance | ✔ Additional insurance up to $1,000,000 | ✔ Additional insurance up to $1,000,000 |

| Multiple Currencies | ✔ Available account currencies: USD, EUR, GBP, CHF | ✔ Available account currencies: USD, EUR, GBP, CHF |

| Leverage | ✔ Up to 1:200 | ✔ Up to 1:400 |

| Dedicated Account Manager | ✘ No account manager available | ✔ Dedicated account manager included |

➔ Open your free trading account with ActivTrades now

(Risk warning: 66 – 79% of retail CFD accounts lose money)

Review of the deposit and withdrawal

As part of choosing a CFD Broker, you’d want to trade with, you also need to be aware of the process of how deposits and withdrawals work with the brand you’ll pick. With ActivTrades, deposits or withdrawal requests can all be done from the trader’s Personal Area. The firm accepts various payment options to fund the account, including bank transfer, credit/debit card, Neteller, Skrill, and Sofort.

Processing time for deposits or withdrawals reflects ActivTrades reflect ActivTrades processing time and do not take into account the timing of the financial institution where the account is held. Please see the table below for further information on the time frame processing:

| PAYMENT METHOD: | FEES: |

|---|---|

| Bank transfer | Free, USD withdrawal $12.50 |

| Credit/Debit Cards | Free, 1.50% Non EAA countries |

| Neteller | Free |

| Skrill | Free |

Is there a negative balance protection?

Both the personal and the professional trading accounts have a negative balance protection included. During normal circumstances the margin close-out level on every account is in place to ensure that the balance doesn’t go negative. However, in certain market conditions, where liquidity dries up and the next available price differs substantially, a margin stop-out level may not be sufficient. As an added safeguard, the negative balance protection available to all ActiveTraders account holders will guarantee, that no account will go negative.

How does the broker earns money?

The broker ActivTrades earns money through additional spreads on the CFD markets. There is also the possibility that they earn money by an interest rate differential for overnight fees.

- Additional spreads

- Interest rate differential

Fees and costs for ActivTrades Trader

ActivTrades offer from 0,45 pips minimum spread for FTSE and from 0,5 pips for all major forex pairs. Opening a demo account with ActivTrades is free of charge but the minimum initial deposit for a live account is $100. The firm doesn’t charge any withdrawal fees and has no hidden fees. If you have a live account with ActivTrades and that account has no trading activity for 6 consecutive months (180 days), then the firm. will charge you $10 per month for the following months.

Facts about ActivTrades fees:

Trading fee

- The minimum initial deposit is $1,000

Spread

- Minimum variable 0,5 Pips

Inactivity fee

- Charges an inactivity fee of $10 per month after 6 months

Commissions

- Does charge commission on CFD shares

No hidden fees

ActivTrades does not charge a withdrawal fee (only USD withdrawal)

➔ Open your free trading account with ActivTrades now

(Risk warning: 66 – 79% of retail CFD accounts lose money)

How does this broker make money from you?

A broker platform generates revenue from its users by leveraging various fees and commissions associated with the trading process. Whenever an investor places a trade, the platform may charge a transaction fee or a commission based on the size and type of the trade executed. Additionally, some broker platforms profit from the bid-ask spread, which is the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept. Lastely, brokers may earn interest on the cash held in clients’ accounts, or charge account maintenance or inactivity fees. These revenue streams allow the broker platform to sustain its operations and continue offering services to investors.

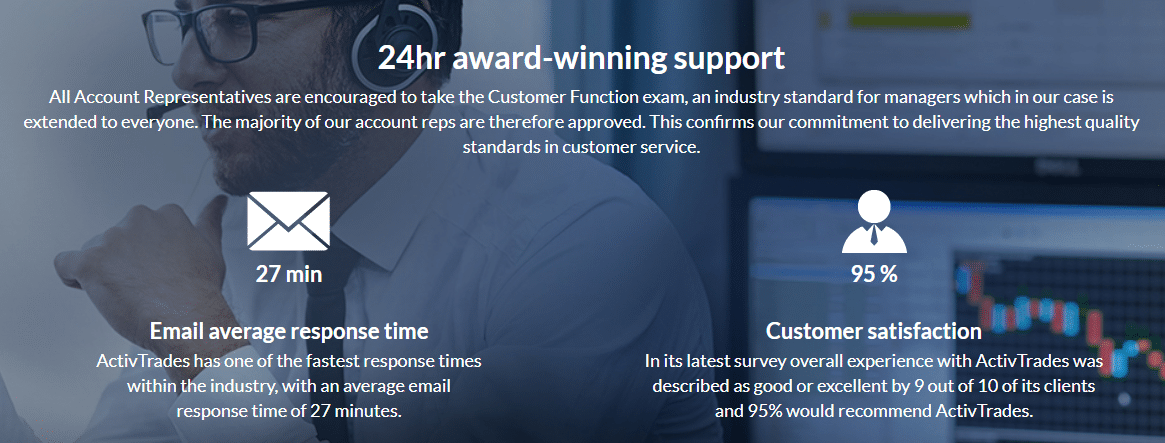

ActivTrades customer support and service review

The customer support and services of ActivTrades are award-winning multilanguage support. In the latest customer satisfaction survey, the result was described by 9 out of 10 of its clients, as good or excellent and 95% would recommend ActivTrades. The company has the fastest responsive email support with an average email response of 27 minutes. It operates 24 hours a day 5 days a week and supports 14 languages. The company has phone support, email support, and as well as chat support. You can also request a callback with ActivTrades and it is for free.

You can contact their phone support on their main number which is +44 (0) 207 6500 500 or their support desk number which is +44 (0) 207 6500 567. For email support, the support desk email address is englishdesk@activtrades.com, the sales desk is info@activtrades.com, and the institutional desk is institutional_desk@activtrades.com.

ActivTrades also provides training and educational materials to its clients to help them be prepared to trade online. The firm promotes its programs One To One Training, Webinars, Seminars, and Educational Videos.

One to One Training program is ActivTrades training sessions that are designed to support traders in the basics and start with trading together with Activetrades. There is a dedicated team that will go through the trading platforms of ActivTrades and its products with you, and other essentials to understand fully how to trade with ActivTrades.

Webinars, seminars, and educational videos are a big help in any trader’s journey for a better trading experience. These programs are an offer by ActivTrades to assist its clients in successful trades.

Facts about the support:

- Multilanguage support (supports 14 languages)

- Operates 24/5

- Fast responsive email support

- Phone support

- Chat support

- Email support

- Online support center with FAQs

- Offers educational and training materials

- Award-winning customer support and services

➔ Open your free trading account with ActivTrades now

(Risk warning: 66 – 79% of retail CFD accounts lose money)

ActiveTrader alternatives – Which brokers are better?

Finding your ideal broker may take some time and involves some testing, as each provider has different choices in terms of assets, usability, and functions. In case you like to test an other provider, here are some of your favorite alternatives.

1. XTB

XTB is a well-established and reputable broker that has been in operation since 2002. With headquarters in Poland and offices in over ten countries, including the UK, Spain, and Germany, XTB has gained a strong foothold in the financial market. The broker offers access to over 3,000 markets, including forex, indices, and commodities. Additionally, XTB is regulated by several financial authorities, including the Financial Conduct Authority (FCA) and the Polish Financial Supervision Authority (KNF), providing clients with a high level of security and trust.

2. Capital.com

Capital.com is a well-established and reputable online trading platform that has been providing services since 2016. With headquarters in London and a presence in over 50 countries worldwide, the broker has quickly gained a reputation for providing a user-friendly platform and innovative features to its clients. Capital.com offers access to over 3,000 markets, including forex, commodities, and shares. Additionally, the broker is regulated by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC), providing clients with a high level of security and trust.

Conclusion of the review: Is ActivTrades legit or a scam? – We think it is legit!

ActivTrades is one of the leading brokers in the trading industry that offers forex pairs and CFDs in competitive spreads. It won various awards and has been continuously expanding until today. It is a trusted, reliable broker that promotes the best execution and no dealing desk. It offers tight spreads that suit any type of trader to fully execute trading potential.

Please be aware that the company has an important disclaimer with regards to trading CFDs. About 71% of retail investor accounts lose money when trading CFDs with this provider. CFDs are complex instruments and come with a high risk of losing money. You should consider first whether you understand how CFDs work, and if you are willing to take the high risk of losing your money.

The platforms of this firm are popular and are proven and tested to be safe and reliable. We can truly say that the company’s client protection programs make it a good broker and it is regulated by a known regulator namely FCA. It is a legit broker with excellent multilingual customer support and services. The educational training and materials of the firm are a big help in a trader’s trading journey.

Advantages of ActivTrades:

- Regulated company (FCA)

- More than 450 assets

- Reliable and competitive spreads

- Award-winning CFD Broker

- User-friendly powerful platforms

- Mobile trading

- Fast execution

- 24/5 multilingual customer support

- Educational materials

ActivTrades review

Overview and test of the broker ActivTrades.

Trusted Broker Reviews

Regulation

Platform

Trading offers

Customer support

Deposit

Withdrawal

Summary

ActivTrades is a secure trading platform with competitive spreads and no hidden fees.

4.9

We recommend trading with ActivTrades if you are searching for a very safe online broker and personal customer support.  (4.9 / 5)

(4.9 / 5)

Trusted Broker Reviews

➔ Open your free trading account with ActivTrades now

(Risk warning: 66 – 79% of retail CFD accounts lose money)

New York Stock Exchange

New York Stock Exchange Australian Stock Exchange

Australian Stock Exchange Toronto Stock Exchange

Toronto Stock Exchange Johannesburg Stock Exchange

Johannesburg Stock Exchange Bombay Stock Exchange

Bombay Stock Exchange New Zealand Stock Exchange

New Zealand Stock Exchange Nigerian Stock Exchange

Nigerian Stock Exchange Kenya Stock Exchange

Kenya Stock Exchange